The Dawn of the Age of Value Pricing in Cancer?

What will the ASCO Value Framework mean for the industry? Ram Subramanian from Simon-Kucher & Partners gives six items to think about.

Although cancer care represents a small fraction of overall healthcare costs, its contribution to healthcare cost escalation is increasing faster than those of most other areas. Some have suggested that part of the reason may be that the adoption of newer, more expensive diagnostic and therapeutic interventions may not be well supported by medical evidence, thereby raising costs without improving outcomes. With the advent of high-deductible plans and increased cost-sharing imposed by payers for cancer treatments, patients are bearing a larger proportion of their treatment costs. Treatment costs have a meaningful impact on a patient’s finances. All of these reasons have prompted the American Society of Clinical Oncology (ASCO) to consider cost data in addition to clinical data when determining the value of cancer treatments.

This is why every Pharma and Biotech manufacturer needs to know the answer to the following questions:

· What is the value assessment framework ASCO proposed for cancer treatments?

· Why is ASCO proposing a value assessment framework?

· What are the implications for pharma and biotech manufacturers?

The Times They Are A-changin'

The U.S. spends more on healthcare than other developed nations and healthcare spending is expected to rise further. According to the Centers for Medicare & Medicaid Services (CMS), healthcare spending will grow at an average rate of 5.7% for 2013-2023 and is projected to be 19.3% of GDP by 2023, up from 17.2% in 2012. Although cancer care represents a small fraction of overall healthcare costs, its contribution to healthcare cost escalation is increasing faster than those of most other areas. Some have suggested that part of the reason may be that the adoption of newer, more expensive diagnostic and therapeutic interventions. There is also concern that some of these interventions may not be well supported by medical evidence, thereby raising costs without improving outcomes.

ASCO is also concerned about the increasing financial burden on patients due to increasing patient co-payments and the advent of high-deductible, consumer-directed health plans (CDHP). A majority of large (500+ employees) and very large employers (20,000+ employees) are expected to offer CDHPs to their employees by 2017.

All of these reasons have led ASCO to look beyond just the clinical benefit of cancer treatments and consider costs too. To do that, ASCO has developed a framework that assesses the value of cancer treatments by comparing the relative clinical benefit, toxicity, and cost of treatment.

The ASCO framework for assessing value in Cancer Care

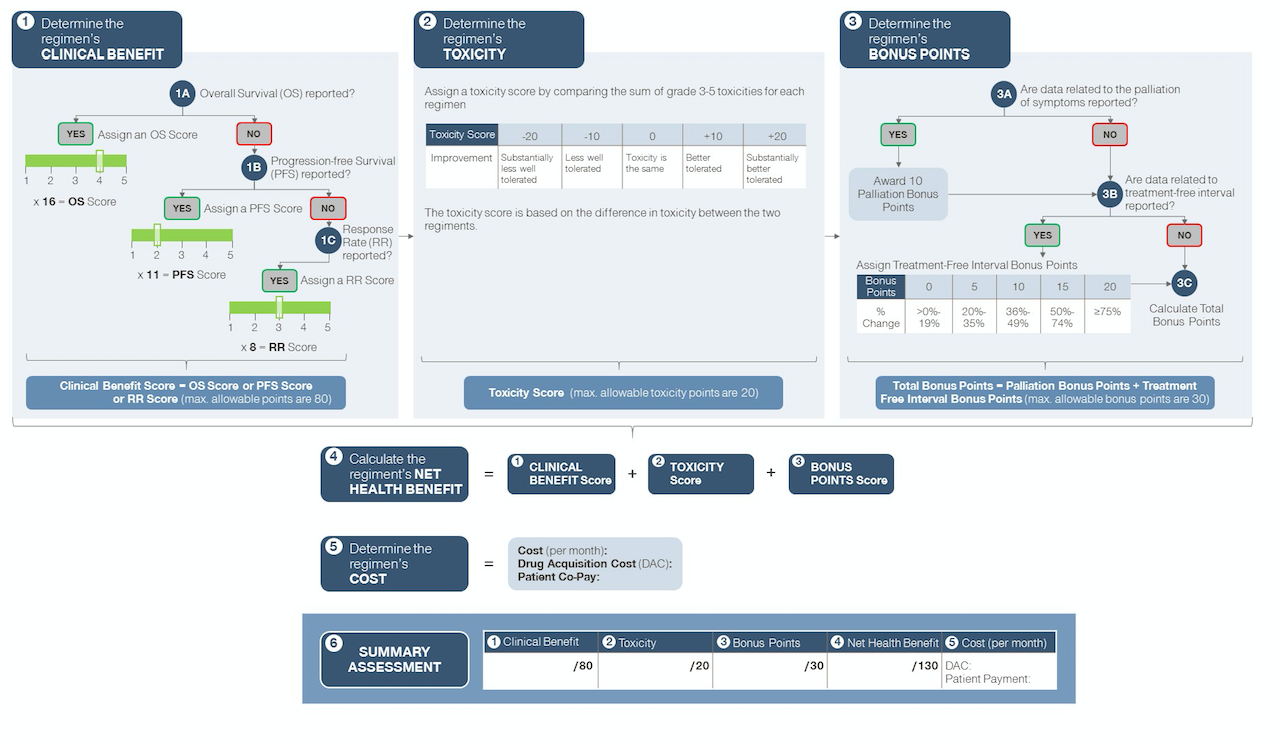

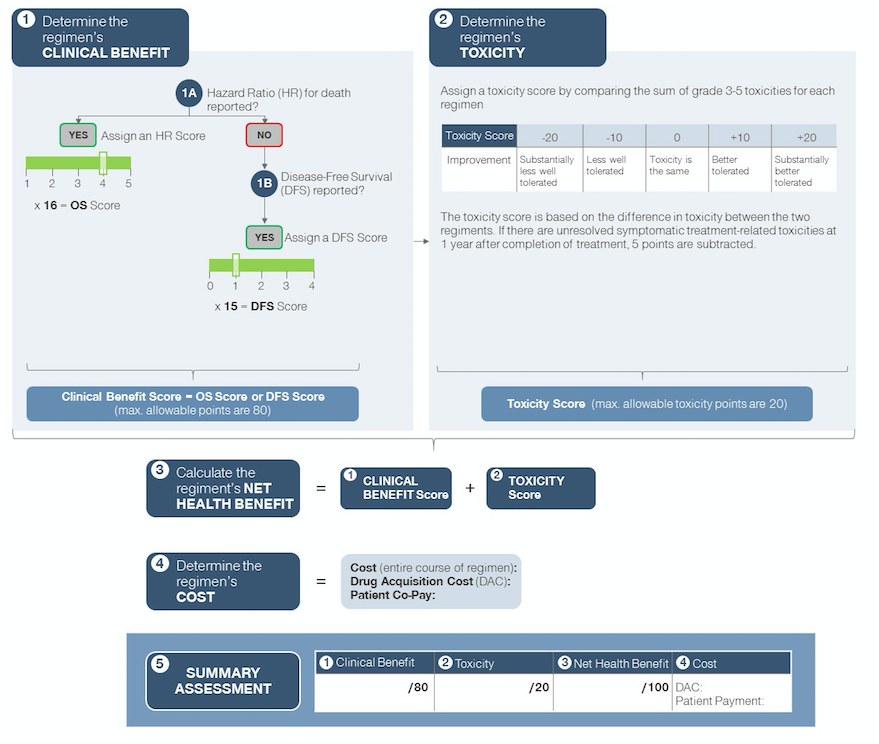

The ASCO value framework is a physician-guided tool to help the physician and patient in shared decision making. It enables comparisons of a new treatment regimen with the prevailing standard of care for a specific clinical cancer indication based on data derived from a prospective randomized clinical trial. The framework calculates a net health benefit (NHB) score by awarding (or subtracting) points for clinical benefit and toxicity. In the framework specific to advanced disease, bonus points can also be earned if a regimen shows statistically significant improvement in palliation of symptoms and/or treatment-free interval compared to the trial comparator. The NHB is juxtaposed with the direct cost of treatment, to provide an overall summary assessment (see Figures 1 and 2 - Source: Schnipper et al. Journal of Clinical Oncology, June 2015. ASCO Statement: A conceptual framework to assess the value of cancer treatment options.).

Figure 1: Simplified schematic of ASCO Value Framework for advanced disease

Figure 2: Simplified schematic of ASCO Value Framework for adjuvant setting (early stage disease)

Six implications of the ASCO value framework for Pharma and Biotech manufacturers

1. Manufacturers should be prepared to discuss the cost of their treatments with physicians

While in the past most physicians have limited their value assessments of treatment options to purely clinical evaluations, they are beginning to pay more attention to cost and financial implications for their patients. Indeed, the term “financial toxicity” has emerged in the medical community lexicon to symbolize the devastating effect of the financial burden on the patient resulting from treatment costs. The ASCO framework is a first step in providing physicians with the tools to make clinical and cost comparisons. Going forward, physicians are more likely to be aware of the need to consider cost while making treatment choices and will have some of the necessary tools to do so. Manufacturers should be prepared to discuss the cost implications of their treatments with physicians and to present convincing arguments on how patients will be able to gain access to their treatments.

2. Payers will push physicians to make cost-effective treatment selections

Payers have traditionally looked at treatment costs along with clinical information but have generally opted for a “light touch” approach when evaluating cancer treatments. For the most part, payers have allowed physicians a considerable degree of freedom when choosing cancer treatments. Even with the implementation of clinical pathways, physicians have the ability to deviate from prescribed regimens. The ASCO framework represents the endorsement of the medical community and comparisons made using the framework are likely to carry a lot of weight in future payer evaluations. Payers are likely to use the clinical-cost comparisons to push physicians to re-evaluate treatment selections especially if the treatments are very costly and do not represent adequate value.

3. Manufacturers will need to choose the right trial comparator to highlight the value of their products

The scoring system used in the ASCO framework depends on the trial comparator used and the evaluation is only valid in the context of the chosen trial comparator. So depending on the trial comparator used (if there are multiple trials) there could be several scores for a given treatment regimen. Manufacturers will need to pay attention to these nuances and be prepared to have arguments supporting the choice of the most appropriate trial comparator to be used when evaluating the treatment in the context of the ASCO framework.

4. Manufacturers will have the opportunity to translate lower toxicity and positive impacts on patient quality of life into better overall value

The NHB score includes a toxicity score. Additionally, treatments for advanced disease can gain bonus points if they show statistically significant improvements in a randomized trial for palliation in any cancer-related symptoms and/or treatment-free interval. The safety and quality of life benefits of a treatment can lead to an improved value assessment even if there is no improvement in overall survival (OS), progression-free survival (PFS), or response rate (RR). The ASCO framework allows the quantification of safety and patient quality of life benefits and manufacturers can use this information to help position their products in a favorable light.

5. Manufacturers will need to master the details of how the NHB score is calculated

The scoring system in the proposed ASCO framework is based on a discrete scale as opposed to a continuous scale. Therefore, treatments that have numerically higher/lower performance may not necessarily get a higher/lower score. For example, a treatment that shows a 25% improvement in median OS vs. the comparator gets the same OS rating as a treatment that shows a 49% improvement (products that show a median OS improvement of 25% - 49% get a rating of “2”). The OS improvement is almost doubled but the clinical score remains unchanged. It will be important for manufacturers to be aware of such nuances in the calculation so that they can prepare appropriate arguments for their products.

6. Manufacturers should be prepared to counter the publicity risks of relying on a numerical score to represent value

Drug costs are all over the news these days. With the launch of immuno-oncology drugs that cost upwards of $100,000 per year and the expected combination use with other high-cost therapies, the media’s focus on drug pricing will only increase. The ASCO framework attempts to quantify the clinical benefit and compare it with cost metrics. However, the clinical scores need to be evaluated in the context of the specific disease, currently available treatments and their performance, prevalence of the disease, trial comparator, etc. It is more than likely that media outlets will pick up on a score from the ASCO framework and publish it without the nuanced discussions surrounding the particular situation for a cancer treatment. Relying on a numerical score to represent value in the absence of appropriate context can lead to negative publicity Manufacturers will have to learn to effectively counter such situations if they are to avoid a media backlash.

Conclusion

The ASCO framework is a recognition by the U.S. medical community that physicians needs to holistically evaluate the value of cancer treatments based on a comparison of clinical benefit and cost. ASCO has published a framework to assist physicians discuss the relative value of new cancer therapies with their patients in a user-friendly and standardized way. As the framework develops and sees greater adoption, it will be important for manufacturers to fully understand the details of the framework as well as its limitations in order to be able to set the tone for discussions on the value of cancer treatments.

References

1. Centers for Medicare & Medicaid Services. National Health Expenditure Projections 2013-2023. Retrieved from http://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/Downloads/Proj2013.pdf

2. Shih et al. Journal of Clinical Oncology 31:4151-4157, 2013. Delivering high-quality and affordable care throughout the cancer care continuum.

3. Mercer. National Survey of Employer-sponsored Health Plans. Retrieved from http://www.forbes.com/sites/danmunro/2015/01/04/u-s-healthcare-spending-on-track-to-hit-10000-per-person-this-year/

4. Schnipper et al. Journal of Clinical Oncology, June 2015. ASCO Statement: A conceptual framework to assess the value of cancer treatment options.

Trump: 'Major Tariff' on Pharmaceuticals Coming Soon

Published: April 9th 2025 | Updated: April 9th 2025“We’re going to tariff our pharmaceuticals, and once we do that, they are going to come rushing back into our country," President Donald J. Trump said during a Tuesday night dinner in Washington.

ROI and Rare Disease: Retooling the ‘Gene’ Value Machine

November 14th 2024Framework proposes three strategies designed to address the unique challenges of personalized and genetic therapies for rare diseases—and increase the probability of economic success for a new wave of potential curative treatments for these conditions.