Biomarkers Come of Age

In a few years' time, or so the conventional wisdom goes, personalized medicine will become a reality, and many (or even most) new drugs will come to market supported by tests that will help physicians make the decision of who gets what drug, what's the appropriate dose, and who's in the greatest danger of serious side effects-all based on a better understanding of biological processes and newly available data from testing at the molecular level to characterize patients and disease. We're not there yet, of course. To date only a handful of drugs are accompanied by molecular-level diagnostic tests. At the 2005 Molecular Medicine Tri-Conference, Ian Massey, PhD, senior vice president and head of research and preclinical development at Roche, expressed the opinion that molecular diagnostics will only affect a few medicines in the near to mid-term.

In a few years' time, or so the conventional wisdom goes, personalized medicine will become a reality, and many (or even most) new drugs will come to market supported by tests that will help physicians make the decision of who gets what drug, what's the appropriate dose, and who's in the greatest danger of serious side effects—all based on a better understanding of biological processes and newly available data from testing at the molecular level to characterize patients and disease. We're not there yet, of course. To date only a handful of drugs are accompanied by molecular-level diagnostic tests. At the 2005 Molecular Medicine Tri-Conference, Ian Massey, PhD, senior vice president and head of research and preclinical development at Roche, expressed the opinion that molecular diagnostics will only affect a few medicines in the near to mid-term.

Before progress toward the goal of personalized medicine can be seen in the clinic, it must be preceded by changes in the R&D programs of pharmaceutical and biotechnology companies, as biomarkers become an essential part of drug development.

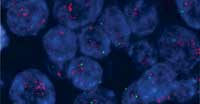

The term "biomarker" is used in a variety of ways. In this article, it will refer to genomic, proteomic, or metabolic characteristics that are objectively measured and evaluated as an indicator of normal biological processes, pathogenic processes, or pharmacological responses to a therapeutic intervention. Biomarker tests can look at proteins, RNA, DNA, and so forth. In some cases, the quantity of a biomarker or its presence or absence are the definitive indicator. In another example, through imaging techniques, it is possible to look at where the biomarker is localized in the body and whether receptor sites are occupied or not.

Walter Carney

Biomarkers have numerous potential uses, both in the pharmaceutical R&D effort and in the clinic. They can help to:

- diagnose specific diseases, often at early stages

- identify patients who will respond or not respond to a treatment

- set dosage levels for individual patients

- eliminate drug candidates by identifying potential toxicity early

- identify individual patients at high risk of experiencing side effects

- stratify patients to improve clinical trials.

In 2003, Stan Bernard wrote that pharmacogenomics is "a reality of business in the pharmaceutical industry today, and its impact is likely to grow dramatically." (See "The Five Myths of Pharmacogenomics Pharm Exec, October 2003.) Two years later, how have pharmaceutical companies progressed in the discovery, development, and incorporation of biomarkers into clinical trials? Is the use of biomarkers creating a significant competitive advantage, leaving behind companies that are not embracing them? When can we expect biomarkers to change patient stratification—in most clinical trials and in treating patients? With the ability to select the right drug for patients comes the next series of steps that lead to fulfilling the promise of personalized medicine.

For this article, seven professionals from five large pharmaceutical companies were interviewed in the second quarter of 2005 to gain their opinions and outlook. The purpose of these interviews was to identify new possibilities for biomarker-based tests in conjunction with new drugs and to understand how pharmaceutical companies are approaching organizational and technical changes to incorporate biomarkers into the R&D/Phase IV process.

Eiry Roberts

Five Perspectives

In his presentation at the 2005 Biomarker World Congress, Hans Winkler, PhD, senior director of functional genomics for Johnson & Johnson, noted significant changes for biomarkers over the last two years. In his view, biomarkers are now consciously being incorporated into clinical trials, and there is a stronger link between disease and target due to biomarkers. According to multiple presenters at conferences in 2005, pharmaceutical companies appear to be in general agreement that biomarkers should be available by Phase IIa to test and refine the hypothesis in Phase IIb and Phase III trials.

The use of biomarkers early in the process sets up the hypothesis and potentially advances the timeline for later trials. If biomarker data is to be available for regulatory submission, use of biomarkers in Phase IIa/IIb is critical. Companies currently using biomarkers in Phase IIa/IIb–Phase III are better positioned to advance than their counterparts. Thus, this approach becomes a key portfolio decision step.

Various companies are organizing their biomarker efforts in different ways:

Novartis is one industry leader in its embrace of biomarker technology. Four years ago, the company instituted a safety assessment biomarker program at the preclinical stage of compound development to reduce failures in clinical trials. Two years ago, Novartis made an R&D commitment to implement biomarkers from discovery through Phase IV, putting this global line function in place under the responsibility of Jacky Vonderscher, PhD, vice president and global head of biomarker development.

In the past two years, the company hired new personnel in key executive positions to ensure biomarker plans and programs are consistently in place to impact the attrition rate of compounds early, accelerate proof-of-concept trials, and define clinical safety and efficacy biomarkers early in the process.

Stephen Williams

At Eli Lilly, "The key goal is to improve technical success for our molecules in clinical development," explains Eiry Roberts, MD, vice president, project/program medical. This process translates into an active reduction in uncertainty around key technical risk factors (for example, toxicology, clinical dose selection, exposure/response, and so forth), and shifts the attrition curve to earlier in the process across the portfolio.

Biomarker strategies in support of new compounds help to optimize the portfolio, not the individual molecule. At present, the focus is on early-stage development, when discovery teams are asked to develop biomarker tools to assess drug activity, safety, and efficacy in the clinic.

"As compounds move from discovery to validation, the biomarker strategy is implemented," explains Brian Edmonds, PhD, principal research scientist at Lilly. "As each compound passes the go/no-go decision, the biomarker strategy is brought forward on a case-by-case basis for compounds that receive a 'go.'"

Bristol-Myers Squibb initially created separate groups for clinical biomarker technologies but found the model to be ineffective. One year ago, the company fully integrated clinical biomarker personnel into the drug development process, making them part of therapeutic-area teams and enabling them to gain a robust understanding of the area by consistently working with the same group.

Biomarker strategies for each compound are developed early in the drug development process. The clinical discovery group (from Phase I to proof of concept) is responsible for implementing the clinical biomarker strategy. These changes are beginning to show signs of success.

"The key is to gain therapeutic area consensus around what we are/are not doing. By putting biomarkers into the routine development processes, organizational consensus on priorities and goals are gained, as is consistency in decision making," says Nicholas Dracopoli, PhD, vice president for clinical discovery technology.

Pfizer global research and development organizes its biomarker effort vertically, according to Stephen Williams, PhD, MD, the company's executive director and worldwide head of global clinical technology platforms, who supports all therapeutic areas. The company has developed biomarker best practices in research and development, which cover the plan, properties/use, tolerability of risk, performance, and minimally acceptable criteria for performance.

Pfizer is continuing to change its internal processes to further support broad use of biomarkers and other technology, within the context of desired commercial impact on its products. At its New York headquarters, the clinical platforms group is applying business plans to advance biomarkers as part of Pfizer's diagnostic agenda.

Nicholas Dracopoli

"In the past year, the situation went from one of 'Why biomarkers?' within parts of the organization to one of solid support from management," says David Lester, PhD, Pfizer's New York site head for global clinical technology platforms, who regularly interacts with the commercial groups in CNS, cardiovascular, allergy/ophthalmic, and oncology.

One commercial expectation is that the use of biomarkers and other technology may support or revitalize products that are already on the market, gaining better patient loyalty, higher response to treatment, and more patient subpopulations for drug treatment.

Bayer's new chairman of healthcare, Arthur Higgins, views personalized medicine as a way to differentiate its products from other companies'. Bayer has focused on biomarker programs in both oncology and cardiovascular at an early stage, says Walter Carney, PhD. (Carney heads OncogeneScience, a division of Bayer HealthCare, whose serum HER2/neu test is marketed as a microtiter test by DakoCytomation in an automated format available on the ADVIA Centaur immunoassay system by Bayer Diagnostics.)

The company's oncology effort was linked closely to a new drug, and the cardiovascular effort was brought forward by the availability of BNP (B-type natriuretic peptide) for acute coronary syndrome about two years ago. This latter test, in conjunction with other known risk factors, can be used to predict survival, as well as the likelihood of future heart failure.

Brian Edmonds

One of Bayer's compounds, a kinase inhibitor called sorafenib (BAY 43-9006), is moving through the approval process for renal cancer and is also in Phase III with other cancers as new indications. This drug received a major biomarker focus prior to the initiation of clinical trials for new indications.

"This was a good example of the OncogeneScience and therapeutic groups at Bayer working together to ensure that biomarkers were available for drug trials," Carney says. OncogeneScience is also working closely with GlaxoSmithKline on its new drug lapatinib, a dual tyrosine kinase inhibitor that targets HER2/neu and epidermal growth factor receptor (EGFR).

These companies are clearly taking the initiative to apply biomarker technology by discovering and advancing the biomarkers and associated information to develop and deploy offense and defense strategies (see "Offense or Defense"); companies that are not taking this initiative or that view biomarkers as an "added effort" will have to deal with the consequences. Having strategies for both offense and defense may be advantageous, especially when addressing scenarios and possible outcomes for clinical decisions and patient stratification for clinical trials (which later affects commercial and portfolio decisions).

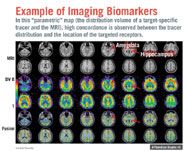

Example of Imaging Biomakers

Varying Technical Approaches

In developing biomarkers, says Novartis' Vonderscher, "One type of biomarker or one technology is not enough in many cases." For example, if only a cellular focus is investigated, the physiological aspects are often lacking, and cellular response may not reflect the larger biological system. "Growth hormone would not have been discovered if discovery had been done only at the cellular level," Vonderscher says. Multiple approaches are required to get the answer, and more than one type of biomarker (DNA, RNA, protein, biochemical) can be essential to detection.

In early development at Eli Lilly, for example, many different markers are pursued simultaneously, including DNA, RNA, protein, and metabolites; the goal is to think in terms of systems biology when deciphering the data.

"All these technologies are relevant," says BMS' Dracopoli. The mix of technologies chosen to create a panel depends on the biological endpoint being investigated. "Panels of biomarkers are required when biologically heterogeneous endpoints are pursued," he says.

There is wide agreement that panels of biomarkers will become the norm. "Multiple biomarkers are probably a better reflection of the disease state," said Mitch Dowsett, PhD, Royal Marsden Hospital, London, at the American Society of Clinical Oncology's 2005 annual meeting. They also provide a better view of the "multi-dimensional quality of clinical response," as Douglas Throckmorton, MD, acting deputy director of FDA's Center for Drug Evaluation and Research, put it at the 2005 Biomarker World Congress.

Biomarker discovery Pharmaceutical companies generally pursue biomarkers in relation to pathway analysis and in conjunction with hypothesis-driven, deductive, knowledge-based target discovery. However, work on biomarkers presents a scientific opportunity to rediscover biology by better understanding individual diseases and their associated pathways.

Lilly's Edmonds gives an example. When his company was developing Xigris (drotrecogin), a new treatment for sepsis, the project team went to the literature and selected six classical markers of inflammation. When they were tested as a possible biomarker set, though, they failed.

A second set of biomarkers was chosen, using an inductive, data-driven, "pure discovery" approach. Not only were the markers in this second set different—but they had not previously been considered as a combination for sepsis. The second set was put into validation studies and brought forward.

Toxicology There is currently a lack of biomarkers for important toxicity endpoints and for toxicology in general, although several companies mentioned that major breakthroughs will be forthcoming this year.

At Lilly, biomarkers are being used to predict hepatotoxicity from preclinical information. The company is working with FDA to develop biomarker standards that will enable the company to evaluate hepatotoxicity in the clinic.

An important goal involves using biomarkers to discover ways to identify toxicity as early as possible in animal studies. For example, Novartis researchers who conducted animal studies for a number of compounds targeting inflammation found that particular gene expression signatures (RNA) in animal gastric tissue could predict gastrointestinal toxicity as early as day one.

Once they had identified the signature, they found that it also occurred in white blood cells, indicating that blood testing could be used as surrogate for GI tract toxicity for this class of compounds. (Traditional methods of determining animal toxicity require at least one full month to be predictive for humans.)

In a broader application, Novartis is also showing that organ-specific gene expression signatures can be used to detect the effects of compounds on various organs.

Drug response Although it appears that many companies are working on biomarkers in the area of drug response, few have commented on specific examples. Two exceptions are Novartis and BMS.

Working on a nervous system indication in which there was a large placebo effect, Novartis evaluated genotypes and identified 12 single nucleotide polymorphisms (SNPs) in six genes that permitted researchers to stratify patients to maximize the difference in response after four and 12 weeks of treatment. (For more on SNPs, see "Snip, Snip, Snip")

Fifty percent of patients did not have the SNP variation; their response rate was similar to the placebo group (31 percent compared to 27 percent). When patients had the defined changes in the SNPs, the drug-treated group demonstrated a markedly higher rate of response (62 percent) compared with the placebo group (23 percent).

These genes were either associated with the drug target or were mechanistically plausible. This was the first time that this combination of biomarkers was demonstrated for this type of disease; it was validated in a second independent study according to the new guidance on pharmacogenomics data submission.

More aggressive companies are looking to discover biomarkers that will help predict patients' response for an entire class of drugs. "The emergence of class-specific biomarkers is inevitable over the next five years," Dracopoli says. A current example comes from BMS' work on its new drug ixabepilone (BMS 247550). Because ixabepilone and Taxol (paclitaxel) both affect polymerization of tubulin, preventing cellular division, it is likely they share some markers for drug response.

This hypothesis was tested, beginning with human cell lines and animal testing, and showed that gene changes from IC50 response in a human cell line predictive model had similarities with a response profile in animals. By the time the compound progressed to an early Phase II trial, the goal was to prospectively test whether these markers that had been identified (or some subset) could be used in human patients to predict drug response of the tumor.

Some similarity in gene changes was evident in the Phase II neoadjuvant trial, showing that biomarkers are a very useful tool in critical path research. This predictive profile will be tested in subsequent clinical studies.

By using biomarkers this way in Phase II and III trials, BMS is enabling an offense strategy, with implications for other, competitive compounds in the same class. In addition, class-specific rather than drug-specific biomarkers may be more cost effective at the physician/patient level—an important consideration in promoting the widespread use of personalized treatment.

Imaging Sometimes the key to understanding a disease or therapy is a matter of understanding not just what biomarkers to measure, but where they are localized—for example, discovering where specific receptors are occupied or not. In those cases, biomarkers enhance functional imaging. "Looking at the biological activity within an anatomical context (for example, receptor occupancy) can be much more important than looking at solely the anatomy," says Lilly's Edmonds.

In a Novartis investigation using a PET tracer to assess drug activity and mechanism of action (via displacement) for "a nervous system target in a psychiatric disease that is by definition not well defined," researchers found a high concordance between tracer distribution and location of specific receptors. This outcome confirmed the drug activity and mechanism and supported assessment of receptor distribution in humans to support clinical development of the drug candidate.

Biomarkers in Clinical Trials

After two years, Vonderscher says, biomarkers "have reached full integration across R&D" at Novartis, and the company has early biomarker plans in place for each compound. But that doesn't mean that 100 percent—or even close to 100 percent—of Novartis trials include innovative biomarkers. That will not happen until programs launched two years ago progress to Phase IV. Meanwhile, the company is putting diagnostic partnerships in place, with an eye toward developing companion tests for drug candidates.

Another area where the company has made great progress is in using biomarkers in Phase IV trials, especially in oncology, CNS, and cardiovascular. The opportunity in these trials is to study the disease, gain samples for additional testing, and define subsets of patients (for patient stratification based on risk or efficacy).

Novartis routinely develops safety biomarkers for new compounds early in research. By knowing the target and looking at which organs are affected, researchers can more easily identify a compound's impact on the wrong organs.

"We look within a given pathway, both upstream and downstream of the target, to look for any indication of toxicity," Vonderscher says. "Consequently, and as a 'positive' by-product, we have several examples in the pipeline where a drug that failed in early safety testing was identified to hit another target that could be interesting for another disease," Vonderscher says.

For example, a CNS drug was dropped because it induced apoptosis of gastric secreting cells in the stomach. In the old paradigm the compound would simply have been "killed" because it affected the wrong organ. Under the new paradigm it can be explored as a potential treatment in some stomach diseases. "From a 'failed' compound with a clear phenotypic read-out, we can find a new pathway/target important for another disease," Vonderscher says.

Use of biomarkers in early stage clinical trials has grown considerably in the past few years.

- Lilly's Roberts, who has responsibility for trials through Phase II, says 80 to 90 percent of early stage clinical studies have some form of biomarker measurement to support the elucidation of drug activity, safety, and efficacy parameters.

- Pfizer's Williams also puts the figure for his company at 80 to 90 percent. He says the exceptions are situations when efficacy trials are simple and inexpensive to conduct, or when traditional tests are so good that biomarkers are not expected to substantially improve decision making.

- At Bayer, Carney reports that biomarkers are included in all programs at some level. Since oncology is a top priority, 90 to 100 percent of these clinical trials include biomarkers.

Areas of Impact

Various clinical areas are expected to move toward adoption of biomarkers at different rates.

Oncology All professionals interviewed expected oncology to realize the largest gains from biomarkers over the next five to ten years (see "How Much Impact? And When?"). There are several reasons for that:

- Genetic changes are the disease.

- Tissue is readily available for testing.

- The disease is life-threatening, creating an urgency to find a treatment solution and a greater willingness to accept risk.

- Patients are very sick and often receive a number of drugs in a short time.

- Patients have low clinical response rates to treatment.

In addition, oncology has a strong pipeline of drugs in development and has a number of smaller companies engaged in innovative research. Already, physicians have access to tests that help identify breast cancer patients at low risk for recurrence, who may not benefit from systemic adjuvant therapy (see "Breast Cancer: The Test Case" ). In another area of cancer, Novartis' successor to Gleevec (imatinib) is in Phase II/III and appears to be less susceptible to the development of drug resistance. This drug is being developed with a battery of tests to define which patients should receive it.

In Roberts' opinion, more and more new drugs in oncology are being pursued with parallel development of a diagnostic test. She also expects to see more changes in drug labels associated with genotyping of drug-metabolizing enzymes in the future.

Cardiovascular At first glance, cardiovascular may not look like a good area for biomarker development. The cardiovascular field is complex, and includes a number of overlapping diseases. Also, the area has been well served by simple, low-cost tests, such as blood pressure and cholesterol measurements. Nonetheless, some gains in individualization of treatment for cardiovascular patients are expected.

To Vonderscher, the "one size fits all" paradigm of treatment encourages physicians to practice trial-and-error medicine to find the best prescription for an individual patient. But this sort of physician-level segmentation means that a company often loses more patients than it gains if its new drug is effective only in a subset of a patient population; it will be more practical to actively segment using a biomarker.

And though blood pressure and cholesterol measurements have been effective, Pfizer's Williams points out that they don't address issues such as plaque stability and size. He predicts that the clinical biomarkers in cardiovascular will include intravascular and carotid ultrasound, and in vivo tests for plaque composition and stability using imaging. Carney predicts that biomarker tests to guide new treatments for cardiovascular disease will be available over the next five years.

Roberts envisions the cardiovascular area as progressing, since key academic leaders are pushing for more and better tests, including those encompassing metabolic syndrome, a constellation of health-oriented changes affecting cardiovascular, diabetic, and obese patients.

Neuroscience In Lester's view, and that of Vonderscher, Dracopoli, and Edmonds, biomarker improvements in neuroscience will come first in several difficult-to-treat diseases where the potential for gain is enormous, including Alzheimer's, schizophrenia, and pain.

The biology of these diseases is not well understood, and the phenotype is complex. This hampers the biomarker discovery and development process, but there is promise in Alzheimer's to assess the benefit of treatment using imaging and other biomarker techniques. Roberts expects complex diseases, such as schizophrenia and depression, to be most difficult, with biomarker applications developing at a later date.

Other indications Many diseases with long onset and long time to progression require clinical trials that take years and large numbers of patients to determine the benefit of biomarkers or new treatments. For such indications, establishing the value of biomarkers will be longer term.

However, Edmonds suggests that biomarkers might have a positive impact on metabolic diseases, such as diabetes, relatively soon—after all, a diabetes trial using biomarkers can show effects in patients on a timeline that is shorter than using traditional clinical measurements. On the other hand, immunology and asthma are considered two therapeutic areas in which biomarkers are not expected to have an impact in the near future.

Expectations

It is difficult to predict a timeline for future biomarker impact, and estimates vary widely. Vonderscher, for instance, estimates that 20 percent of pharmaceutical R&D is currently improved by post-genomic biomarkers and that this number will increase to 70 percent by 2008. Dracopoli, on the other hand, estimates that 10 percent of R&D is currently affected and that this number will increase to 50 percent by 2008. "This will happen drug by drug," he says.

"The number of trials using biomarkers will increase over three years," says Edmonds. "In principle, at Eli Lilly, all trials will have biomarkers included in the protocol by then, since every compound must have a biomarker strategy in place for management approval for compounds to advance. Some aspect of biomarkers will be there, principally to identify responders to maximize patient enrollment."

Roberts estimates that biomarkers could be in widespread clinical use in oncology in five to 10 years. Regarding co-development of a diagnostic test with a pharmaceutical product, the challenge, she says, is to create novel assays in parallel with a clinical development plan, without delaying the clinical development plan—which will require very early partnership.

Full panels of tests (for example, a group of tests to evaluate response for various drugs in the same therapeutic area) are further off. They will depend a great deal on companies' business models, desired market position, capitalization, and other factors—which will probably mean development will be slower than anyone currently thinks. "I would say 10 years, but I would not be surprised if it is less or longer," Edmonds says.

It is possible that the impetus to create such panels of tests may even come from others than pharma companies themselves. For example, a diagnostic company may develop such a panel, which may be supported by payers who desire to control/rationalize expenditures.

Carney estimates that a panel of tests to predict outcomes is about five to 10 years away from being available and another seven to 10 years away in terms of physician adoption. He projects that angiogenesis will be the next area where a combination drug and diagnostic test become available, because of the large number of new drugs in the pipeline.

What's Next?

The use of biomarker-based tests in the clinic clearly fits with what physicians are looking for—a way to better treat patients. However, the timing for the appearance of new biomarker tests is expected to be slower than most people outside the industry expect, and the timing of biomarker impact within various therapeutic areas will certainly differ. Short-term challenges include the education of clinical study sites on how to use biomarkers, and education of practicing physicians in relevant early-adopter clinical areas.

To truly gain the value of personalized medicine, though, a larger market-development process will be required, one that encourages collaboration among patients, prescribers, diagnostic and pharmaceutical manufacturers, academic groups, payers, and regulatory institutions. That process will be ongoing for a long time, but the investments, initial returns, and acceptance along the typical technology-adoption curve are underway in leading companies and in the marketplace.

Today's investments in biomarkers for R&D will lead naturally to the arrival of new drug/biomarker test combinations in the market. And there is reason to hope that as diseases and patient subgroups are redefined based on the continuing use of biomarkers, these tests may become even more of a solution, not an added effort.

One thing is certain: There will be an increase in the use of panels consisting of multiple biomarkers. The next advance—using different types of biomarkers together (e.g., DNA plus protein, RNA plus protein, etc.)—is already surfacing, and it will be facilitated by new instrumentation that allows two types of molecules to be detected simultaneously.

This April, Edmonds, working with an outside vendor, received new data showing that a technology platform could simultaneously test RNA and protein. And in late May, Olympus and Cangen Biotechnologies announced their plan to co-develop hybrid DNA- and protein-based diagnostic tests that can detect early stage lung cancer using microarray technology.

Today, smaller companies are coming into play, working with pharmaceutical companies to discover, develop, and implement biomarkers, as well as to independently create new diagnostic tests. These companies will push innovation as large pharmaceutical companies turn to them for technology, biomarkers/biomarker approaches, and in some cases, as diagnostic partners. Companies that have taken an offensive approach with biomarkers will lead and are already seeing benefits.

But given the timeline for the development, validation, and deployment of new biomarker tests, it will take considerable time for a company to catch up if doesn't already have biomarkers in place. A purely defensive strategy will be costly, in terms of market share, addressable product potential, and product usage.

Commercialization and Portfolio

Today, research and development organizations seem to be the principle drivers for implementation of biomarkers. But if patient stratification is to succeed at the product level (that is, in the hands of physicians), the marketing and sales functions must fully participate to ensure success. This is already happening at some companies.

At Novartis, for example, Phase IV oncology trials must include the use of innovative biomarker tests, and the trials are supported by marketing dollars. But in other pharma companies, it will take a concerted effort to turn around these more customer-facing areas. It may even be necessary to replace current personnel in order to achieve the necessary level of change.

The question is: When will companies change sufficiently to allow all relevant functions to work in concert to implement biomarkers throughout the commercialization process? Obviously, multiple areas of the pharmaceutical organization that regularly interact with physicians and patients will need to change practice in order to fully support the use of biomarkers by physicians. Key areas of change will include:

- physician education

- programs to support point-of-care decision making

- allocation of personnel and assets to support therapeutic decision-making that is increasingly biologically determined

- biomarker expertise within customer facingmedical, regulatory, marketing, and sales organizations.

The specifics of how and when these areas are expected to be affected may be the subject of a future article in Pharmaceutical Executive.

Offense or Defense?

Biomarker-induced market changes are due to arrive over the next five to 10 years. But they are already creating a competitive advantage today, as companies pursue offense and defense strategies.

Offense attacks are expected to come in many different forms, such as (1) biomarker-enhanced products seeking to displace older products through superiority in safety, efficacy, or patient preference; (2) payers, providers, or governmental bodies seeking to limit prescribing volume for a therapeutic class; and (3) innovation on the part of diagnostic companies that restructure prescribing volumes for a disease category.

Defense strategies require preparation now: It will be difficult to mount a defense once the attack has already been launched, given the number of years it takes to conclude relevant biomarker studies—and the limited lifecycle of profitability for patented products.

Every company should have a joint biomarker technology development and licensing/acquisition strategy to monitor biomarker evolution, engage potential biomarker co-development partners, and to license or acquire biomarker technologies.

Senior executives in every major pharmaceutical and biotechnology company can soon expect to be faced with a major biomarker "difficulty" dealing with portfolio allocation of major assets against late-stage opportunities. Based on five- to 10-year projections of future markets, the portfolio analysis and relevant marketing organizations need biomarker-related data and skills to help senior management make informed competitive decisions today.

Breast Cancer: The Test Case

Hormone receptor (HR) status has been used to direct the treatment of breast cancer for 20 years. But in the past two years, new biomarker-based tests have emerged to identify patients at low risk of recurrence. The first tests are for RNA detection or for the identification of DNA copy number changes in tumor samples; these latter tests can accurately identify low risk of recurrence in both HR positive and HR negative patients. The advent of biomarker testing will undoubtedly have an impact, according to Hans Winkler, PhD, senior director of functional genomics for Johnson & Johnson, who suggested in his presentation at the 2005 Biomarker World Congress that in the future, it may take five drugs to treat breast cancer—one for each subtype.

But getting physicians to use specific biomarker-based tests takes time, proof in practice, and education, as evidenced by the seven-year history of HER2/neu testing to define which patients should be treated with Genentech's Herceptin (trastuzumab). Today, physicians sometimes refer to "HER2 disease," and HER2/neu testing is ordered routinely.

Tests like the HercepTest with Herceptin, and EGFR pharmDx with Erbitux (cetuximab), have focused almost exclusively on the question of: "Which patients will benefit from a specific treatment?" It remains to be seen how EGFR testing might be used for Erbitux, Tarceva (erlotinib), or Iressa (gefitinib). As an emerging example of a biomarker-based test with the potential to have an impact on the use of multiple drugs, the Roche AmpliChip CYP450 detects changes in the 2D6 and 2C19 genes to address the small genetic differences in individuals that result in a significant difference in drug metabolism for some commonly used drugs.

Suzanne Z. Mattingly, PhD, is vice president, business development and marketing, for Exagen Diagnostics. She can be reached at smattingly@exagendiagnostics.comBo E. H. Saxberg, MD, PhD, is founder and president of DDO Strategic Services, LLC. He can be reached at bsaxberg@ddostrat.com

Addressing Disparities in Psoriasis Trials: Takeda's Strategies for Inclusivity in Clinical Research

April 14th 2025LaShell Robinson, Head of Global Feasibility and Trial Equity at Takeda, speaks about the company's strategies to engage patients in underrepresented populations in its phase III psoriasis trials.

Beyond the Prescription: Pharma's Role in Digital Health Conversations

April 1st 2025Join us for an insightful conversation with Jennifer Harakal, Head of Regulatory Affairs at Canopy Life Sciences, as we unpack the evolving intersection of social media and healthcare decisions. Discover how pharmaceutical companies can navigate regulatory challenges while meaningfully engaging with consumers in digital spaces. Jennifer shares expert strategies for responsible marketing, working with influencers, and creating educational content that bridges the gap between patients and healthcare providers. A must-listen for pharma marketers looking to build trust and compliance in today's social media landscape.

Pfizer, GSK Gain ACIP Recommendations for RSV and Meningococcal Vaccines

April 18th 2025The Centers for Disease Control and Prevention’s Advisory Committee on Immunization Practices voted to expand access to Pfizer’s respiratory syncytial virus vaccine Abrysvo for high-risk adults in their 50s and voted in favor of GSK’s meningococcal vaccine, Penmenvy, for streamlined adolescent protection.