Chilean Pharma: Exploring Beyond Copper

Pharmaceutical Executive

This loosely populated nation of almost 17 million is considered to be Latin America's economic powerhouse, with a pharmaceutical industry estimated at $1.5 billion

Considered to be Latin America's economic powerhouse, Chile is typically a solitary country that is forgotten, or remembered, because it is the most politically and economically stable in the region and therefore produces minimal headlines for the world—unless they involve tragic seismic events or heroic mining rescues. This loosely-populated nation of almost 17 million is ranked as the 30th most competitive country in the world (ahead of Brazil and Mexico), holds an A+ credit rating, a AA grade for investments and is the only Latin American nation accepted as a member of the OECD. With health indicators such as life expectancy and infant mortality rates that rival those of most developed nations, surely this country's healthcare and pharmaceutical sectors must also be thriving. Indeed Chile's pharmaceutical industry, estimated at US$1.5 billion in 2010 and expected to reach US$2 billion by 2015, is lucrative but has not always been the most popular among Big Pharma. For decades the country has been notorious for producing the cheapest similar and generic drugs in Latin America, some of them marketed in violation of patents and without proper bioequivalence studies. With other serious issues such as the concentration of distribution channels into three main pharmacy chains that control 93% of pharmaceutical sales and the dominance of a "lowest price wins" public healthcare system, representing 80% of the population, the country's pharmaceutical sector quickly became uninviting for innovators. This was up until 2006 when then President Bachelet saw the great need to overhaul the healthcare system of her country and began a series of reform policies that marked the beginning of the sector's revitalization. While efforts are still ongoing, the push for a modern and efficient healthcare system is in full force today and the country is now poised to offer fresh and attractive opportunities within its own borders and beyond, for local and foreign companies alike.

PHOTO CREDIT / DIEGO CARCAMO SILVA

SANITIZING THE HEALTHCARE SYSTEM

Pharmaceutical demand in Chile is focused on 80 diseases that are covered by the Regime of Explicit Health Guarantees (GES-AUGE) healthcare program enacted in 2005, which ensures government-funded coverage for patients regardless of age, class, and ability to pay. While this universal health plan covers four-fifths of the population, under Chile's dual healthcare system the remaining 20% is entitled to pick their coverage from a number of private insurance companies known as ISAPRES. Jorge Rodriguez, CEO and general manager of Deloitte Chile, explains that "the private healthcare system began operating in 1981 and since then it has been perfecting itself to offer the highest quality services. Governmental authorities have witnessed this transformation and today are aiming to improve their provision of healthcare so that it is on par with those offered by the best private providers in the country." As a key partner to the healthcare sector, Rodriguez aims "to assist the government in their objective of providing better healthcare to a greater number of people in Chile" by providing consulting and advisory services to the government's reform initiatives.

"A major issue for our healthcare system is related to the structure and quality of health institutions, including hospitals and regulatory entities." - JAIME MAÃALICH, MINISTER OF HEALTH

Leading today's healthcare reform is Minister of Health, Jaime MaÑalich, who is determined to iron out the inefficiencies of the healthcare system to reflect the rest of the country's economic and political achievements. "A major issue for our healthcare system is related to the structure and quality of health institutions, including hospitals and regulatory entities," he asserts. Two main entities on the Ministry's radar are the Public Health Institute (ISP), the regulatory agency for the pharmaceutical industry, and the National Supply Center (CENABAST) that is the public purchasing entity and distributor for all public hospitals and clinics—the pharmaceutical industry's de facto biggest purchaser. A recent audit of CENABAST conducted by advisory firm PWC, brought to light the severe inadequacies of the institution and the desperate need for a professionalization of its activities. Minister MaÑalich explains that "the underlying problem is that CENABAST does not have the adequate facilities and capacity to handle the logistics required to supply the system appropriately. We are therefore proposing to delegate this responsibility to the private sector by having pharmaceutical laboratories deliver directly to hospitals and clinics." Initiatives such as this will save the government millions of dollars in health expenditures that will allow for the coverage of higher quality treatments under the GES plan, therefore narrowing the gap between private and public healthcare options. Other proposals in the pipeline include the liberalization of OTC products that today are, paradoxically, kept behind the counters and sold only in pharmacies, as well as the creation of a National Pharmaceutical Agency (ANAMED) that will be solely charged with the registration and regulation of pharmaceutical products—a task that today is overseen by the overwhelmed and underbudgeted ISP. The director of the ISP, Maria Teresa Valenzuela, echoes the need for drastic change and stresses that "the key area for this new administration is the search for quality in all possible aspects—from administrative management up to the most detailed analysis of technical processes". For Valenzuela this also means improving protocols and approval of clinical trials, as well as enhancing the bioequivalence capabilities of the institution by "supporting the accreditation of three new centers of bioequivalence in the country in partnership with three major academic institutions".

Maria Teresa Valenzuela, Director of the Publich Health Institute (ISP)

As regards the old tales of Chilean imitators violating patents, the National Institute of Industrial Property (INAPI) has been at the forefront in setting the record straight. Chile is one of the countries in the world that has signed on to the most free trade agreements, including one with the United States and an Association Agreement with the European Union. Maximiliano Santa Cruz, national director of INAPI, admits that Chile "committed to several obligations in these treaties, many of them impacting directly on the pharmaceutical sector, such as extending the protection of patents in case of delays which we are already running in INAPI and ISP." Part of his institution's efforts to optimize patent regulation includes a direct partnership with the national police's "IP brigade" in charge of IP enforcement and national customs agencies. With such proposals already rolling, Santa Cruz is bold enough to proclaim that "INAPI is going to be the best IP agency in Latin America in the future."

Maximiliano Santa Cruz, National Director of the National Institute of Industrial Property

FRESH NEW FIELD. LET'S PLAY BALL!

As a direct consequence of healthcare optimization, international innovators are seeing greater opportunities to grow their operations in the Chilean market. Jose Manuel CousiÑo, executive vice president of the Chamber of the Pharmaceutical Industry in Chile (CIF), representing the international innovators in Chile, explains that the country "has the advantage that it is an economy truly based on the notion of free trade and competition." Now that the playing field has been leveled for the MNCs, due to better regulation by the authorities and greater access to innovative products within the public system, the possibilities for major growth are within grasp. As a strategic consulting partner to the Chilean pharmaceutical sector, Rodrigo Castillo, business manager for IMS Health in Chile, provides a more in-depth analysis when explaining that innovators "suffered more in Chile up until 10 to 15 years ago, when there was no patent protection and the competition [there] was very strong. At this point in time, Chile has managed to learn how to compete and are in a better position." Furthermore, "multinationals are now consolidating and improving their market share and have future plans of getting their products into the GES program, which would highly benefit them," says Castillo. This renewed momentum is also evident in the sharp increase of clinical trials that are being conducted in the country by them with the aim that innovation is valued for its worth in the local market. "Chile has great research centers and universities and a very good scientific community, which makes it attractive for these kinds of studies," concludes CousiÑo. The country has also updated is clinical research legislation to accelerate the work of ethics committees and the approval times for trials and is now the fourth-largest market for clinical trials in the region.

Jose Manuel CousiÃo, executive Vice President of CIF

Leading the innovator revolution in Chile is none other than megalith Pfizer, who today is following close on the heels of the national pharma companies coming in as the No. 1 MNC in the country. Undoubtedly the company has benefited from its recent acquisition of Wyeth, not only in the expansion of its product portfolio and sales force, but also because Pfizer Chile general manager, Monica Zerpa, was the former general manager of Wyeth in Chile. Ever the optimist, and one of the very few top women executives in the industry, Zerpa believes that Pfizer has "many opportunities here, thanks to the solid regulatory framework for the pharmaceutical market and to the country's economic and political stability." She is of the opinion that MNCs brought upon their own past failures in the Chilean market because they chose to focus on the challenges of the industry. "I think multinational pharmaceutical companies in Chile have remained very static in their approach and we must become more flexible regarding the prices, services, and access to products that we offer. We need to learn how to become more agile and responsive to this dynamic market, and that's what I aim to bring to the company," she says.

Monica Zerpa, General Manager of Pfizer

This agility is exemplified by Zerpa's decision to "create a sales structure with representatives specially trained to support our institutional clients, such as hospitals, patient programs, and CENABAST. The Chilean government has been modernizing the public healthcare system over the years, and we must ensure that our services take these reforms into account so that patients have wider access to our products. I am confident that this will also make our products and services more competitive—vis-à-vis low-cost generics." Beyond their sales strategies, Pfizer has seized the advantages of Chile's updated regulatory environment and rich scientific community for clinical research and has already completed 49 of its trials in the country. Even more impressive is Sanofi-Aventis' dedicated clinical research center in Santiago that in 2009 invested US$6.3 million into its operations.

Rene Delsin, General Manager of Roche

Indeed Mauricio Rosas, managing director of Merck's pharmaceutical division, also believes that the current environment is promising for innovators. "Even though we are facing tough competition from generics and private labels, we are still top-of-mind for our clients. Our sales force is exceptional because it has managed to build strong relationships with the practitioners," he says. Their sales prowess is so impressive that they have been asked by BMS, AstraZeneca, and Novartis to commercialize some of their products in the Chilean market. "If we include the BMS products that we distribute, then Chile is actually the country with the highest market share for Merck in Latin America. Moreover, Chile represents 5% of the Latin American operations in terms of sales for the group, which is a very good figure taking into consideration that the Chilean pharmaceutical market in general is only 3% of Latin American sales," details Rosas. Riding on the company's local excellence, he foresees that "in the next few years the market is expected to grow at 6% and we plan to maintain our growth rate at the actual level of 12%." With such figures it is evident that global innovators have learned the ways of the Chilean market and are taking advantage of the opportunities being created by the optimized healthcare sector. MSD general manager Henrik Secher expresses this best by saying: "I wouldn't say that we have completely resolved these issues in Chile, but we have been dealing with them for a lot more time here and this means that we have greater chances to fight back and to leverage our position."

Katia Trusich, General Manager of Genzyme

PUBLIC HEALTHCARE GOES PREMIUM

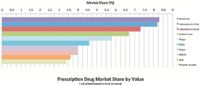

The country's impressive economic success over the last decade, together with the ongoing modernization of Chilean healthcare, is creating a greater demand for innovative treatments. Chile's increasing wealth is reflected by Santiago's shiny glass skyline and luxury megamalls, but also in the quality of healthcare and medical treatments being demanded by the population, including those covered by the public healthcare system. Furthermore, as a true free-market economy, the liberalization of the industry to include private healthcare providers and insurance companies is allowing patients to pick and choose their medical treatment options, causing first-class products and niche segments to become solid drivers of the industry. This trend is illustrated in the marked difference of a ranking of the top 10 pharma companies in the country in terms of units sold versus one measured in terms of value. The first only includes two innovator companies, namely Merck and Bayer in the eighth and 10th positions, respectively, whereas the second lists Pfizer as the fifth-most-important company, immediately followed by MSD, Bayer, Merck, and GSK in descending order. Such figures are also indicative of the increasing consumption of innovative products by the public system, including premium and niche products. As a whole the country is slowly moving to improve the quality of treatments available to the population.

As the leader of the Chilean biotech offering, Roche is the prime example of a company benefitting from upgrades in the public healthcare system. General manager Rene Delsin comments on the successful implementation of pilot programs to introduce new products into the public sector: "With these programs, such as one for our HIV products, we were able to gain access to the public system serving 80% of the population." The company already dedicates 50% of its portfolio to oncology products, most of which fall under the public healthcare plan, and is currently growing above the market driven by their biotech offering. Delsin describes the company's strategy as one that is migrating from primary care to high-tech drugs. Lilly has been taking a comparable approach to the Chilean market by targeting therapeutic areas that are currently not addressed by the public system. Cesar Buendia, general manager for Chile, Peru, Ecuador, and Bolivia, explains that "given Chile's highly competitive environment, I would say the main challenge is indeed to continue providing new innovative treatments to address unmet medical needs, which is our main objective, in a way that is timely and cost-effective". The company is leveraging their position in the market by specializing in neurological diseases, erectile dysfunction, and diabetes that are all covered under the AUGE-GES plan. Buendia further states that "as long as there are patients that can benefit from innovative products then we as a company will strive to provide them."

Farmindustria plant

Another unusual success story has been that of Hospira in Chile, which until very recently functioned as the headquarters for the Southern Cone region. Even though the company has not introduced new pharmaceuticals beyond its initial eight products since it began its operation, it have managed to double its sales in the last five years entirely based on its high-tech medical devices. Aldo Arata MuÑoz, general manager of Hospira Chile, explains, "This year my plan is to open up the market to our infusion security software and to expand our sales in this segment by convincing the hospitals that this is a very important issue for them. It won't be an easy endeavor, but it is definitely our big chance for growth, and I would like Hospira to be the first company working on this issue in Chile to differentiate our medical devices in this way." The company is betting that its software offering will be valued by the public hospitals enough to drive its sales beyond its past performance.

Andres Rudolphy Fontaine, General Manager of Andromaco

Similarly, Baxter has been expanding its business in Chile by focusing on its end-stage kidney disease and hemophilia products. As a matter of fact, the company is one of the few MNCs that still has production facilities in Chile and has been putting them to good use at the local level. General manager Christian Quiroga elaborates that, "Today, we also export products to other Baxter facilities in Ecuador and Central America, but that only represents about 10% of our total production. The rest is entirely for the local market." The Argentine manager has been exploring to further diversify its portfolio in the public system as a means to drive growth. "In Chile, bioscience products, which include therapies for hemophilia, are awarded on a tender basis, and represent one of our greatest growth opportunities," concludes Quiroga.

Francisco Medone Crovetto, CEO of ÂITF-Labomed

As premium and niche segments are increasingly recognized, new product offerings have been constantly sprouting throughout the country, bringing the most innovative treatments into the market. Genzyme only established itself in the country in 2008, but nevertheless has managed to introduce 15 of its products for rare diseases mostly through the use of educational initiatives. "We have done a lot of work on medical education, which is the main challenge for rare diseases, because you need to make sure that doctors are fully trained to correctly diagnose patients and have an impact in the development of the disease" says general manager, Katia Trusich. Her strategy for the company is based on the need to "create access to medicines and support the development of new policies that are more open and have higher standards of care for its patients. If we manage to make these changes, then our growth and revenue will follow naturally." The educational approach has also been essential for companies like Novo Nordisk, who aim to transmit the vast advantages of their modern insulin products to Chilean doctors. They certainly have done a fair job so far considering that they have more than 55% of the market share for insulin products and are the official providers for the state.

Hernan Pfeifer Frenz, General Manager of Laboratorio Chile

SMALL DOG, BIG BITE

Today it is evident that changes in the healthcare system have not only affected Big Pharma but also the local industry that has had to adapt, shape up, and keep the pressure on the competition. This has helped develop entirely new strategies and scenarios, including international mergers and acquisitions that today have made "national" industry a difficult term to define. This is the new face of Chilean pharma.

Maria Angelica Sanchez, Executive Vice President of ASILFA

When global pharma shut down local production plants back in the '80s and '90s, contract manufacturing became essential to placate national demand for pharmaceuticals. As a direct answer to this need, Farmindustria bought the former Schering-Plough manufacturing plant in 1998 to later become the largest contract manufacturing in the country. Today Farmindustria is responsible for 40% of all contract manufacturing in the country and has created its own laboratory known as Laboratorio Volta. Roberto Roizman, CEO of Laboratorio Volta and Farmindustria, describes that "the company began as a very small operation 12 years ago, but that was the perfect moment to enter the market because at that time the majority of the global pharmaceutical companies were shutting down their manufacturing facilities in the country. In parallel there were the local companies that were growing very quickly and did not have the capacity to produce all of their products." Farmindustria has remained at the cutting-edge of the industry by investing 50% of its profit on new technology and equipment every year. Furthermore, they have maintained flexibility as a key element of their operations and Roizman describes the company as one "that is willing and able to adapt to the specific needs of our clients. If one of our customers comes to us with a proposal illustrating a new production process with higher quality control standards, then we will do our best to implement the changes and to achieve the highest levels that are required by the international industry."

Fernando del Puerto, General Manager of Pharma Investi

Beyond this the company recently developed a "partnership with Eurofarma in Brazil that is a very reputable company with an extensive international network already in place ... and in this way Volta can increase its role in the region", explains Roizman. The company also is pushing its limits to experiment with innovation and has gone as far as to exploit the country's natural resources to develop a supplemental treatment for cancer derived entirely from a national berry known as Maqui.

Top 20 Ranking

Another notable example of evolution within the local Chilean industry is that of the No. 2 company, Andromaco, that, despite its two manufacturing sites, is concentrating its efforts entirely on the commercialization of its products. It goes as far as claiming that even if its production facilities were to shut down, it would still maintain their current market position entirely based on its sales and marketing expertise. The company is now focusing on penetrating smaller markets in the region, such as Bolivia and Central America, and even plans to acquire a company closer to those locations. Argentine Laboratorio Bago, has also decided to use its Chilean operation for a similar purpose by exporting the majority of its production to the Andean markets.

In a similar fashion, ITF-Labomed CEO Francisco Medone Crovetto tells his company's story of building an international network of partners: "Chile's market size and high competition made me realize that as a non-innovative company the best way for me to grow was through licensing agreements. I then proceeded to look for licensing partners abroad to bring new products into the market, and today 50% of our products are licensed and the other 50% are our own branded generics." After many years of partnership with the Italian group Italfarmaco, Labomed was acquired in 2009 to form the current ITF-Labomed, which served as an entry point into the Latin American market for the Italian mother company. Now that they are part of a European pharmaceutical group, "We have aspirations to have a manufacturing plant that is certified by EMEA," concludes Crovetto.

NATIONAL PHARMA REMIXED

Despite the optimism in the air, the country is still considered to be the most competitive pharma market in the Western hemisphere. Such notoriety is still partly due to a preference for similars and generics by the public healthcare system, with original drugs only representing 19.2% of the market. Another major factor is also the robust manufacturing capacity that Chile has developed over the decades despite the small size of the market. Most exemplary of this is the national manufacturing giant, Laboratorio Chile, "which today is the market leader in both branded and pure generics, and No. 2 in exports and the OTC market," explains general manager Hernan Pfeifer Frenz. The company is the producer of one out of every four pharmaceuticals consumed in the country, and exports 20% of its production to 14 countries. The company's success was so glaringly obvious that the company was acquired by IVAX in 2001 as part of a strategic expansion into the Latin American market, and consequently by Teva in 2006 who acquired IVAX's global operations. All the same, Laboratorio Chile still retains its monolithic brand name as part of the country's pride and joy.

Other notable national companies are Laboratorios Saval and Instituto Sanitas, both operating state-of-the-art production facilities certified under GMP standards and offering extensive product portfolios that cover the therapeutic gamut—from oncology to central nervous system (CNS) disorders, from cardiology to infectious diseases. These triumphs of Chilean pharma today are reverberating in the region like never before, with Laboratorio Recalcine acquiring several Argentine laboratories in the past few years and, even more impressively, a UK allergy-oriented vaccine producer in 2009. Some regional players have decided to become a part of the action in Chile, as was the case with Argentina's pharmaceutical champion Roemmers, who entered the market through its local subsidiary named Pharma Investi and ranked in the top 10. Pharma Investi general manager Fernando del Puerto points out that the company "increased its sales fivefold in the last seven years ... moved up in the ranking and improved its position mostly through organic growth."

The Industrial Association of Pharmaceutical Laboratories (ASILFA) that was created to defend the interests of the generic and local manufacturers is working hard to erase the blemished past of patent violations and to shape a compliant and high-quality national industry. In line with governmental reforms, Maria Angelica Sanchez, executive vice president of ASILFA, explains that its current agenda is focused on raising production standards and increasing the role of innovation as part of the Chilean industry. The first step to achieve this is by ensuring that national health authorities are efficient and up-to-date with global regulatory norms. "The new presidential administration has already begun to address some of our concerns by tackling these problems in small committees that deal with specific topics. These discussions will also include other companies that are not part of our association," she explains.

Addressing Disparities in Psoriasis Trials: Takeda's Strategies for Inclusivity in Clinical Research

April 14th 2025LaShell Robinson, Head of Global Feasibility and Trial Equity at Takeda, speaks about the company's strategies to engage patients in underrepresented populations in its phase III psoriasis trials.

Beyond the Prescription: Pharma's Role in Digital Health Conversations

April 1st 2025Join us for an insightful conversation with Jennifer Harakal, Head of Regulatory Affairs at Canopy Life Sciences, as we unpack the evolving intersection of social media and healthcare decisions. Discover how pharmaceutical companies can navigate regulatory challenges while meaningfully engaging with consumers in digital spaces. Jennifer shares expert strategies for responsible marketing, working with influencers, and creating educational content that bridges the gap between patients and healthcare providers. A must-listen for pharma marketers looking to build trust and compliance in today's social media landscape.