Costs and Benefits of Health Reform

Pharmaceutical Executive

Will expanded markets and ACOs offset higher rebates, added fees, and closer scrutiny of marketing and prices?

Last month, economists in the Department of Health and Human Services (HHS) reported a big slowdown in healthcare spending for 2010. Outlays rose only 3.9 percent to $2.6 trillion, largely because the recession and unemployment reduced healthcare coverage and prompted people to skip doctor visits. Spending on prescription drugs increased at a record low 1.2 percent to $259.1 billion, as utilization stagnated, more generics replaced old blockbusters, and fewer new drugs came on the market.

Jill Wechsler

The Affordable Care Act (ACA) of 2010 is supposed to expand drug reimbursement and use by extending coverage to some 35 million uninsured and promoting preventive services, such as immunization. Equally important are a host of initiatives that promote quality care and risk-based reimbursement, beneficial to pharma marketers able to demonstrate that drug use can improve care and save money.

For 2010, though, spending on drugs by private insurers and consumers actually declined, according to analysts in the Office of the Actuary, Centers for Medicare and Medicaid Services (CMS), as reported in last month's issue of Health Affairs. Medicaid expenditures were notably flat, as higher manufacturer rebates, required by the ACA, reduced total retail drug sales.

Medicare was the only drug program that increased spending in 2010, up 9 percent largely because the government handed out $250 rebates to some 3 million Part D beneficiaries who reached the Medicare coverage gap.

That won't be a factor for 2011, because the burden for closing the "donut hole" has shifted to industry, one of the many ACA provisions with a direct impact on pharma revenues and marketing. Manufacturers began offering discounts equal to 50 percent of the cost of drugs prescribed to seniors in the coverage gap. As of October 31, 2011, those discounts amounted to $1.5 billion for some 2.6 million seniors, primarily those using medicines to treat diabetes, high cholesterol, asthma, heart problems, and psychiatric conditions. HHS will provide added subsidies beginning in 2013 until beneficiaries have to pay only 25 percent of the cost of gap drugs in 2020.

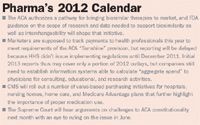

Pharma's 2012 Calendar

The ACA also hits brand-name drug marketers with annual fees, which began at $2.5 billion for 2011 and will rise to $4.1 billion by 2018. The IRS issued rules in August 2011 and guidance in November 2011 for calculating each manufacturer's share of the total based on prior-year sales of brand drugs to Medicare, Medicaid, and other federal government health programs; firms with sales over $400 million a year pay the most.

Despite the high cost of the Part D discounts, richer coverage of "gap" medicines is expected to encourage seniors to continue to take prescribed drugs, instead of cutting back on treatment when they hit the donut hole. And better adherence to prescribed drug therapy is key to driving utilization and sales, provided that marketers can document value and benefits for payers.

Essential Coverage

The cornerstone for expanding coverage for the uninsured is the formation of state-based insurance exchanges that will offer plan options to small businesses and individuals who don't get health benefits from employers or public health programs. Plans sold through exchanges will have to meet a host of quality criteria defined by the ACA, including coverage of "essential benefits" for consumers. The good news for pharma marketers is that prescription drugs are on the list of 10 basic benefits that all plans have to cover. However, instead of establishing a common set of essential benefits for all exchanges across the country, HHS announced in December 2011 that it is leaving it up to each state to set coverage benchmarks that fit local needs and preferences. That may be a plus for pharma in states that require coverage of contraceptives, for example, or specifically authorize reimbursement for off-label drug uses; it could backfire, though, where drug coverage is less generous.

HHS opted for the "flexibility" route largely to deflect charges from health reform critics that Washington is formulating a one-size-fits-all national healthcare system, but there's strong opposition to this approach. Consumer advocates predict that some states will scale back coverage requirements too much, while employers and insurers fear state mandates will make plans too costly. Pharmacy benefit managers are gearing up to oppose state anti-mail-order laws. And everyone will be looking at new policies governing deductibles and copays, which have a significant impact on utilization of services and medication adherence.

ACOs Seek Value

ACA initiatives that shift from pay-for-volume to pay-for-value models also will encourage appropriate drug use. For example, a new CMS quality reporting system for Medicaid programs calls for providers to check whether adult enrollees take antidepressants and antipsychotics as prescribed; regularly monitor meds to treat chronic conditions; and track hospital admissions for patients with diabetes, congestive heart failure, and asthma, which often involve irregular drug use. Similar quality standards apply to a number of value-based reimbursement programs and new pilots to reduce hospital readmissions and prevent heart attacks.

The poster child for this approach is the accountable care organization (ACO), an entity formed by hospitals and physicians to share the risk for improving care and reducing costs. While health systems have been establishing ACO-like operations for some time, the strategy gains support from the ACA provision authorizing a Medicare "shared savings" model: Medicare ACOs can retain some of the savings generated by more efficient coordinated care approaches, as indicated by 33 quality measures; those that fail to achieve quality and savings face rate reductions. Along with risk-sharing, the legislation gives ACOs protection from certain fraud and abuse laws that otherwise curtail hospital/doctor collaborations.

ACOs that assume risk put pressure on pharma marketers to demonstrate how pricey medicines can save money by keeping patients healthy and reducing inappropriate tests and treatment. Patient compliance with prescribed therapy is key, and analysts are examining a range of drug-related strategies to enhance care.

Increasingly, "doctors are aware of the total cost of care, including the cost of medicines and their ability to keep patients out of the hospital," pointed out William Shrank, director of the Rapid-Cycle Evaluation Group at the Center for Medicare & Medicaid Innovation (CMMI) in CMS. He explained at the December 2011 FDA/CMS Summit in Washington that physicians in ACO shared savings programs are looking for information on drug effectiveness and innovative strategies for controlling the cost of care, including formulary arrangements and reduced cost-sharing for more effective medicines. Shrank urged pharma companies to invest in research that will build the evidence base for medication adherence, and not just for their own products. "Cost is only one factor," he observed, noting that drug packaging, treatment complexity, cultural issues, and health literacy also can affect patient behavior.

Medicare ACOs will emerge in coming months, following publication of final regulations in October 2011 that modified initial reimbursement and reporting policies. Providers had balked at requirements proposed last June, and many health systems with ACOs signaled they would not participate in the Medicare shared-savings approach. However, CMMI announced in December 2011 that the initiative will get off the ground with 32 healthcare organizations testing the ACO Pioneer program.

Comparing Outcomes

More evidence on the value and effectiveness of medications and other clinical treatments is the goal of the ACA-authorized Patient-Centered Outcomes Research Institute (PCORI), which is moving forward despite continued controversy over the type of research it will support and how the information will be used. PCORI executive director Joe Selby, who was appointed last May, insists that the Institute won't do cost-effectiveness analysis, something that pharma companies strongly oppose, but admits that the term "cost analysis" is vague and that even talking about "value" raises red flags.

Yet PCORI's potential for improving care and cutting costs is spurring a lot of interest, as seen in a whopping 850 applications to a recent notice announcing grants totaling $26 million for studies on outcomes research methodology. PCORI is slated to finalize its priorities and research agenda in April, which it posted for comment last month.

Jill Wechsler is Pharmaceutical Executive's Washington correspondent. She can be reached at jwechsler@advanstar.com

Navigating Distrust: Pharma in the Age of Social Media

February 18th 2025Ian Baer, Founder and CEO of Sooth, discusses how the growing distrust in social media will impact industry marketing strategies and the relationships between pharmaceutical companies and the patients they aim to serve. He also explains dark social, how to combat misinformation, closing the trust gap, and more.

Is Artificial Intelligence a ‘Product’? Products Liability Implications for AI-Based Products

April 10th 2025As the physical products we use evolve to become increasingly complex, traditional products liability frameworks may not always fit to provide remedies for harm that can result from using novel product types.

FDA Approves Opdivo Plus Yervoy Regimen for MSI-H/dMMR Colorectal Cancer

April 9th 2025Approval of the Opdivo plus Yervoy combination regimen was based on results from the Phase III CheckMate-8HW trial, which was the largest immunotherapy study in patients with previously untreated, unresectable, or metastatic microsatellite instability-high or mismatch repair deficient colorectal cancer.