Creating Customer Value: New Horizons on the Managed Markets Journey

A highlight of the Hay Group's annual study of Sales Force Effectiveness, focusing on managed care markets

The transformative landscape of US health reform presents a significant challenge to the traditional managed market organization within Big Phama. The basic task of demonstrating value to the customer is now more complex than simply obtaining a formulary listing at an acceptable cost. Today, what matters most is pursuing a problem-solving "health solutions" approach, in which the medicine is only one factor in a broader nexus of relationships with the customer. In a nutshell, it's all about making partnerships more productive in terms of the commercial results.

(GETTY IMAGES / DAVID MALAN)

Although most companies recognize the current disconnect in addressing market change, internal efforts to respond are posting mixed results. Why? Complacency may be one reason. Executing a fundamental redesign in the approach to managed markets is not an exercise in tinkering. The goal is not to marginally increase effectiveness, but to commit to building an organization that can solve customer problems and create business-to-business (B2B) partnerships for mutual advantage. This will require the managed care market team to assume more of a leadership role inside the company, coordinate cross-functional solutions, and obtain appropriate funding and resources. Both the organization's external focus and internal dynamics must evolve—and the faster the better. There's much more to it than manipulating an organizational chart or moving a few bodies around.

Managed Markets and Healthcare Reform: Ready for Change?

Healthcare reform will establish state-run exchanges where individual consumers can purchase health insurance. This creates daunting challenges for payers. Should they participate? Can they keep up with frequent changes on a state-by-state basis? Do they have the right lineup of drugs? Can they accurately assess risk? A managed markets organization that can help address these questions not only will create value, but in doing so will strengthen the company's position and influence.

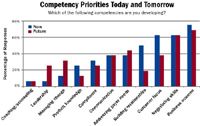

Competency Priorities Today and Tomorrow

Overcoming Internal Barriers

While our research reveals that most companies recognize the opportunity for managed markets to create value, only a few properly estimate the level of organizational effort required. The result: Across the industry, managed market organizations are spinning their wheels. Why this lack of effective propulsion? There are many reasons:

1. Even though customers recognize the potential value that life sciences companies can provide, they are highly skeptical about the commitment and motivations these companies bring to the table.

2. Building B2B partnerships requires highly competent and experienced account managers with sophisticated B2B skills that are not necessarily prevalent in current managed market organizations.

3. These managers must be backed up by cross-functional support teams with complementary skill sets—again, not typically found in current life sciences companies.

4. Managed market organizations are not fully chartered with the authority, reputation, and leadership needed to be the internal change agents that can right this ship.

While these barriers are daunting, the potential payoff for meeting them is huge; larger still may be the consequences for not meeting them. As an industry, life sciences companies have lost as much as $600 billion in market capitalization in the last decade. CEOs and industry analysts know that product-based innovation and differentiation alone will no longer be a dominant driver for business success. The life sciences companies that can begin to reclaim leadership positions will be those that find new ways to create value for the complicated ecosystem of payers and providers that ultimately impact patient experiences and outcomes.

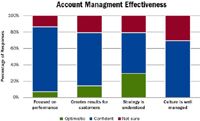

Account Managment Effectiveness

Tracking your Journey

When asked to list the most troubling issues facing managed care organizations, 70 percent of responses pointed to factors that drive account management sales effectiveness. Of these, fully two-thirds are traditional drivers such as time allocation, sizing, access to formulary decision-makers, and product launch discipline. While these drivers are important, success these days is increasingly determined by the other one-third—the new factors that include up-to-the-minute knowledge of healthcare reform and implications for payers and providers; working with new customers such as integrated healthcare providers; and providing health economic data and analysis that is relevant for customers.

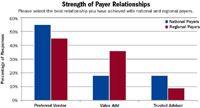

Strength of Payer Relationships

To their credit, managed market organizations recognize the need to address these new sales effectiveness drivers, as evidenced by our data that demonstrates the current emphasis on building competencies around payer needs, building relationships, customer focus, and business acumen. Looking to the future, leadership and change management skills will become more important, signaling a recognition that working with customers to proactively drive results is increasingly important.

While it is heartening that industry professionals are building competencies in line with evolving sales effectiveness drivers, our experience working with life sciences companies tells us that many are behind the curve in adopting sales behaviors that lead to results. In part, this is because high-impact account management is an apprenticed skill—it takes time and an experienced hand to develop a skilled force of account managers.

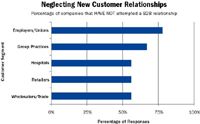

Neglecting New Customer Relationships

There is another dynamic at play here. A predominant focus on payer customers perpetuates a "rebate for volume" account management culture that will remain entrenched until relationships with providers evolve as a consequence of the improved commitment to partnership. These relationships are lagging, as we will further see.

False Confidence About Performance

More than 90 percent of managed market organizations report they have established working relationships with managed care organizations. Asked to describe the effectiveness of account management efforts, most exude confidence. According to most respondents, their organizations follow a clear strategy, focus on performance, and create results for customers. However, a small cloud of uncertainty peeks over this otherwise blue horizon when these same respondents consider their organization's underlying account management "culture."

Gaps in Organizational Invesments

Effectiveness cannot be judged without context, however; when considering account management, it is important to understand the type of relationship created with customers along a continuum of B2B partnerships, from preferred vendor to trusted advisor. Research findings at this level of investigation are striking.

For the most part, after many years of effort, managed markets have created customer-serving relationships with payers. Lower prices are offered for formulary status, and managed market organizations are responsive to customer requests and demands. In this context, success is measured by achieving a "preferred vendor" relationship.

Customer-serving "preferred vendor" relationships, however, are far from B2B partnerships; these relationships are limited to a cut-and-dry exchange of product for price. Our survey did find that organizations—though significantly fewer—have established a higher "value-add" position on the relationship continuum with payers. Tellingly, these higher-level B2B partnerships are more common among less powerful regional payers than with large, national payers. Still, evidence of value-added relationships confirms that some managed market organizations may be able to solve problems and create value. As a test, managed care organizations should determine if their value offerings—including access to scientists, marketing support, and health economic data—are offered as solutions with links to improved business results.

Still, the Holy Grail of B2B partnerships—a trusted-advisor relationship—remains an elusive goal for most managed market organizations. Our customer interviews reveal that payers question the credibility and intentions of life sciences companies, pointing to conflicting actions among their various agents: managed markets, the sales force, marketing, and other functions. Also, payers feel reluctance on the part of life sciences companies to increase their value by dedicating resources to them or helping to measure performance.

These findings may link back to the "cloud of uncertainty" concerning culture and effectiveness. For many managed market organizations, performance strategies dominated by cost containment are at odds with a commitment to creative problem solving.

Crossing Customer Frontiers

Another new finding jumped out from our research: More than half of managed market organizations have not attempted to build a B2B relationship with customers other than payers. Developing partnerships with these "new" customers represents the next frontier for managed markets. Customer segments to be developed include hospitals, retailers, and wholesaler/trade accounts, but may also include reaching patients through direct relationships with employers and unions.

These customers complete the healthcare ecosystem that exists to provide patients with the best possible health outcomes and with an efficient allocation of costs and resources. Companies in the vanguard of efforts to cross this border are finding a self-made barrier to success; the people who fill account manager and support positions today may not be the same people required for success tomorrow.

In our survey, only 44 percent of managed market organizations indicated that they had the right people in place for the required force of the future. New customers with differing business models require people with new competencies and experiences. In today's managed market organizations, developing and hiring the right people—always important business activities—is fast being elevated to a status of "crucial."

Investing in Organizational Progress

According to our research, a majority of life sciences companies are stuck in a traditional mindset when choosing how to invest in improved organizational effectiveness. These companies cling to role improvements and force size as the only priorities worthy of investment. Two other priorities—process improvements and the tough work of improving implementation and execution—are managed as important but underfunded change drivers.

These decisions may be shortsighted and forestall progress toward building relationships, solving problems, and creating value. Here's why: Building fruitful B2B partnerships is not just about having the right number of the right people. Results flow from executing the right behaviors, sustained over time, backed by performance measures and rewards. In short, it's about creating and managing critical processes and following through on promises.

What are the critical processes for solving problems and creating value? Our work with managed markets organizations indicates that account management sales processes that dig deeply into customer organizations and create a network of advocates is important. Another necessary process is one that justifies resources and creates support teams. Partnering with marketing to align messages and initiatives is a third. There are more.

Ultimately, a successful shift of organizational effort from managing contracts to creative problem solving involves a new assessment and balancing of risk. Will the change result in lost market access? Will new organizational investments lead to measurable gains? To some extent, these questions are unanswerable in the short run. But the healthcare market is evolving on its own, and allowing the future to arrive without active participation carries a risk of its own—the risk of inaction, or action without sufficient forethought.

Travel Plans

Among the myriad of actions a company can take to reinvent its managed care organization, here are three starting points that you should consider:

1) Align Resources for Solving Customer Problems. It is true that account managers must possess critical competencies around business savvy and relationship building. But, even the strongest account manager cannot solve payer and provider problems through individual force of will. Successfully creating value for customers requires a team effort. Account management can identify problems and confirm customer commitment for collaboration, but execution demands additional horsepower.

For example, a company may decide to focus on improving the healthcare ecosystem for elderly patients, as Sanofi-Aventis has done. Collaboration with willing payers may lead to smoothing reimbursement practices, while work with providers may focus on treatment protocols and medical staff training. All of this may come together with cobranded marketing campaigns, supply chain improvements, and performance metrics, which include measures in each partners' business. This effort will take time, but will not get off the ground if the proper resources are not first aligned and committed.

2) Create a Learning Process to Capture Value. By design, customer-focused account management creates value for customers. The challenge is to create value for the sponsoring company. In the short-term, value for managed markets and their companies may be conceived as improved customer influence or patient outcomes. However, if success does not lead to improved sales, share, or profitability, commitment to proactive problem solving will wane. Robust performance metrics are essential, but an actively managed learning process is also critical.

Actions that may be included in a well-designed learning process include: regular internal and client account reviews to provide oversight and track progress, customer listening programs that include individual contributors up to senior management, and rotation of high-potential employees through account management and other managed market organizations. This last action will infuse new ideas from new team members, and also carry the learning back to other functions when they rotate back to their primary career track.

3) Plot a Strategic Repositioning. Truth be told, the legacy reputation of managed market organizations is not one of the strategic capabilities for driving critical business results. This will need to change as problem-solving cultures take root and as the opportunity to create higher levels of value grows. Success will require cross-functional commitment of companywide resources, and also increased coordination among other market-facing functions including field sales, marketing, and medical affairs. On this trajectory, account managers will become widely respected and influential with customers and within their company. Support teams aligned with strong customer partnerships will have increasing accountability for driving measurable results, whether they have fixed or dotted-line report arrangements.

All of this will result in strategic repositioning of the managed market organization, by evolution, or in some cases, by actions taken now by the actions of visionary leadership. Actions that can be taken today include adjusting talent programs to staff-managed markets and placing proven individuals in positions of increasing responsibility. Perhaps more importantly, the effectiveness of senior leadership teams across the organization must be judged by their track record of supporting—not impeding—problem-solving and value-creation initiatives. Organizations tend to reject change, and without a successful repositioning of managed markets, the journey may end sooner than desired—far short of its intended destination.

Fostering Creativity

There is a danger in a linear extension of research into business planning. In seeking to align actions with insights, creativity can be stifled and opportunities overlooked. Life sciences cultures tend to be focused on the dual disciplines of science-based R&D and the quantitative modeling of sales force sizing, deployment, and messaging. A diligent effort to surface creative, game-changing ideas may provide excitement, a sense of ownership, and new paths through the industry's current troubles.

One approach is to incubate ideas through internal competitions. This is a common tactic among technology developers, and is based on throwing down a challenge on a difficult, seemingly insurmountable problem. For managed markets, this might involve designing a comarketing program with a powerful player that offers the least potential for collaborative problem solving. Another challenge might be to work with a large healthcare provider to suggest physician compensation and training plans that achieve improved patient outcomes.

The key to these programs is to require that ideas come from self-selected teams and then to reward participants and act on the best ideas. In so doing, barriers will come down as old assumptions about possibilities and constraints are challenged.

Mark Dancer is Hay Group's Sales Effectiveness Practice Leader. He can be reached at mark.dancer@haygroup.com

Carrie Fisher is a Principal at Hay Group and project director of the study. Carrie can be reached at carrie.fisher@haygroup.com.

Ian Wilcox is Global Leader of Hay's Life Sciences Sector and can be reached at ian.wilcox@haygroup.com.

The Misinformation Maze: Navigating Public Health in the Digital Age

March 11th 2025Jennifer Butler, chief commercial officer of Pleio, discusses misinformation's threat to public health, where patients are turning for trustworthy health information, the industry's pivot to peer-to-patient strategies to educate patients, and more.

Navigating Distrust: Pharma in the Age of Social Media

February 18th 2025Ian Baer, Founder and CEO of Sooth, discusses how the growing distrust in social media will impact industry marketing strategies and the relationships between pharmaceutical companies and the patients they aim to serve. He also explains dark social, how to combat misinformation, closing the trust gap, and more.