Dealmaking: Staying Ahead of the Curve

Amid the continued surge in M&A activity, Michael Swanick asks, what are the crucial considerations pharma executives should weigh before sitting down at the deals table?

The record-breaking level of dealmaking activity in the pharmaceutical and life sciences (PLS) sector in 2014 is telling us more than that it will be a good year for investment bankers' bonuses. There are profound strategic shifts occurring in the PLS business that will change the transactions field for PLS companies out across the next five to ten years.

Michael Swanick

Key among those shifts—there's a changing of the guard. Going back several decades, it used to be that household names in the pharma industry, such as Pfizer, Johnson & Johnson, and the like, dominated PLS transactions. While these players continue to be very active, we're dealing with different companies, many in specialty pharma and biotech, that were small entities ten years ago, but after pursuing mergers and acquisitions (M&A) for growth in the years since, are today major players in the PLS deals space. This includes companies like Valeant, for example.

Among other shifts, PLS companies increasingly have to navigate fiscal pressures, sweeping regulatory changes, and an industry-wide shift to consumerism in the new health economy. But this new environment shouldn't be seen only as a challenge—it can be an opportunity for companies to take a step back, assess their current business mix and portfolio, and determine if and how they might better deliver on stakeholder value. Perhaps there are gaps in service offerings that they can fill in or underperforming areas that they may want to consider selling off. If so, M&A, divestitures, and alternative deal structures can all be valuable strategic tools to gain strength in the core businesses and create added value.

PLS companies seeking merger partners and acquisition targets do so for a number of reasons, including to create business synergies and open up new markets. With the ongoing globalization of the PLS sector, the industry has seen an unprecedented number of cross-border PLS M&A transactions. As companies consider these transactions and determine the business strategy, a number of decisions must be made, including where the combined company should be headquartered for tax purposes.

As these trends accelerate, and economic conditions and industry trends continue to create opportunities, PLS companies—household names and new faces—are likely to remain active dealmakers at least out to 2020.

With all this flurry of deal activity, seasoned PLS executives recognize we are operating in a complicated deal environment. More companies are chasing fewer available assets, driving pricing higher according to the age-old law of supply and demand. Amid that increased competition, companies need to be laser focused on identifying those opportunities that are right for them—and being prepared to extract the maximum value from each transaction—either as seller or as a buyer post-acquisition. The good news is that PLS CEOs tend to be ahead of the curve when it comes to their transaction strategies. According to PwC's 17th Annual Global CEO Survey, while global economic recovery remains fragile, immediate economic pressures are easing. CEOs are becoming more optimistic and are gradually shifting from survival mode to a greater emphasis on company growth. Moreover, half of PLS CEOs told us they are actively changing their transaction strategies to uncover new growth opportunities through M&A and other deal structures. They are increasingly confident about their company's prospects and are looking to realign their portfolios in light of evolving industry dynamics to ultimately expand their businesses.

Competitive M&A market

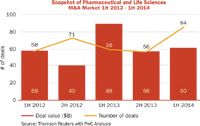

A look at the market's PLS deal activity can be illuminating. The first half of 2014 has seen the most PLS deal activity in history. There were 84 closed deals in the industry—which includes pharmaceutical, medical device, biotechnology, diagnostics, and services companies—a 44%-increase in activity compared to the same period in 2013. On a value basis, total value of closed deals reached $59.6 billion in the first half of 2014. While the level of deal value is less than the same period in 2013, the volume of deals announced is indicative of the overall heightened level of M&A activity in the industry. Looking more broadly at all announced deals, not just closed deals, there was a dramatic rise in announced transactions in the second quarter with 62 of them representing $167.4 billion in value. The high level of deal value announced primarily stems from two large transactions, including Medtronic's pending acquisition of Covidien, valued at $42.9 billion. Furthermore, the pace of M&A activity seen so far this year is likely to create heightened competition among buyers and may lead to an increased number of hostile takeover attempts due to the relative scarcity of acquisition targets.

So which PLS sub-sectors are turning to M&A for a boost? The pharmaceutical and medical device sub-sectors saw the most activity in the first half of 2014 with 28 and 29 transactions, respectively. Medical device deal value more than doubled relative to the first half of 2013, from $3.56 billion to $9.74 billion. Excluding Medtronic's pending acquisition of Covidien, the medical devices sector had an additional 10 deals pending that were announced in the second quarter of 2014, comprising a total potential deal value of $17.1 billion. A majority of this additional value arose from Zimmer Holdings Inc.'s interest in Biomet Inc. at $13.4 billion.

Pharmaceutical companies have seen increasing competition from biotechnology companies in M&A activities. In recent years, there have been a handful of biotechnology companies, including Amgen, Gilead Sciences, and Celgene that have realized significant success from the products they bring to market. As companies in this sector gain considerable strength, they are looking to further extend their role in the industry and M&A is a key component in their strategies. These biotechnology companies, bolstered by product approvals and commercial successes, seek to gain scale and mitigate risk through a more diverse product portfolio. In the first half of 2014, there were 14 announced deals in the biotechnology sector, compared to nine deals in the same period in 2013. By nature, biotech companies are very R&D driven and have a different business model than pharmaceutical companies. With intense competition for biologics, biotech companies have significant pricing power in the M&A market. Biotechs looking to pick up assets to keep their pipelines full have an upper hand in the marketplace because of the synergies they offer to smaller biotechs who want to see their legacy continue with a buyer that has a similar culture to their own. This new competition means that pharmaceutical companies need to be well-positioned with their M&A strategies.

Deal activity in the diagnostics sector saw a very strong start to 2014 with six acquisitions closing in the first quarter worth $19 billion, including the acquisition of Life Technologies for approximately $15.5 billion by Thermo Fisher Scientific. In the second quarter, one transaction—Carlyle's acquisition of Ortho-Clinical Diagnostics, a global provider of solutions for screening, diagnosing, monitoring and confirming diseases, from Johnson & Johnson—closed valued at about $4 billion. This transaction in particular is an example of the ongoing interest from PE firms and other "financial sponsors" in the market, which when added to the acquisition appetite of existing PLS companies, is driving additional competition for the scarce assets that are coming to market. Overall, in the diagnostics sector, it's worth noting that the seven deals closed in 2014 so far equal the volume of deals in all of 2013 and we expect activity in this sector to continue for the foreseeable future.

Getting back to the core

PLS companies today are seeking to continue efforts to gain scale, improve operational efficiency, develop new business models, and adapt to shifting regulatory and economic climates in key markets—all objectives that are presumed to flow from dealmaking. These priorities have prompted several very large transactions while also contributing to mid-size and smaller deals, as companies seek to offer complete product portfolios. One technique being used in the PLS sector by companies looking to realign their areas of focus is the "asset swap"—transactions that allow companies to consolidate in a specific product category or therapeutic area by seeking out assets in that particular space, while also shedding other assets that are no longer aligned with a company's strategic growth plans. Several transactions this year are evidence of this trend. For example, Novartis sold its vaccines business (excluding flu) to GlaxoSmithKline and it has an agreement in place to sell its animal healthcare division to Eli Lilly, and, in turn, acquired the oncology products of GlaxoSmithKline.

The trend of swapping assets is another significant strategic shift we are observing in the PLS industry and one that is likely to continue as successful transactions breed even more efforts to participate. Companies that have cash on their balance sheets but can't deploy it for one reason or another (i.e., the cash is domiciled abroad) are able instead to use asset swapping transactions as a non-cash way to acquire an asset they need and sell something that's non-core to the business. The industry is taking note of the value created in these deals and companies are looking to be opportunistic with their own assets. It won't take much more activity of this nature to say this is a significant strategic trend for the future.

Divestiture planning activities have been on the rise for several years and are expected to continue into 2015 as companies continue to evaluate and optimize business portfolios by selling, carving out, or spinning-off non-core assets. In the past several years, the industry has seen many transactions, including Pfizer's sale of its infant nutrition business for $11.9 billion, Pfizer spinning off its animal health business, the separation of Abbott and AbbVie, and Baxter's proposed spin-off of its bioscience business. Management teams are finding that successfully planning and executing a disposal strategy can be far more challenging than they initially expect, especially when it comes to preserving value across the lifecycle of the transaction. Sellers need to understand their capabilities and the value they bring to a transaction. It is critical to plan for all aspects of the process, present financial information tailored to the deal that is prepared thoroughly and position for the exit and execution.

There are several things PLS companies can do to drive alignment between buyers and sellers, enhance the pace of separation activities, and contribute to a successful divestiture. Sellers need to be agile and informed, enabling them to bring their perspectives to buyers, highlight sources of value, and demonstrate that they thought through the risk associated with the asset and transition. As a result, buyers will engage more effectively with sellers that are prepared, which will likely lead to a more constructive separation process. Ultimately, the alignment of key transaction elements is expected to accelerate the deal timeline and result in enhanced value for both parties. Divestitures can be an extremely efficient way for PLS companies to unlock value. Those that will be successful in extracting the most value from the disposal of non-core assets need to be thinking opportunistically when looking at their portfolio of assets.

Finding success in alternative deal structures

The PLS industry constantly faces pressure to develop new products and bring them to market. But at the end of the day, deals need to have a willing buyer and willing seller who can agree on a value for the asset in question—which can be a challenge when dealing with future projections of a PLS product's value. Given the high cost of R&D, as well as market demand, it's not surprising to see that PLS companies are more likely than those other industries to employ a variety of alternative deal structures, including partnerships, strategic alliances and licensing agreements—structures that adjust for uncertainty in the future value of an asset by allowing both parties to participate in the upside of a deal. In contrast to traditional M&A, these types of deals can take any number of forms. Specifically in licensing agreements, companies look for partners to either provide capital or expertise to further the likelihood of a drug getting through development or the regulatory process. Companies like Pfizer, GlaxoSmithKline and AstraZeneca have found success with these types of agreements for years.

While M&A activity is expected to remain robust, strategic alliances and joint ventures continue to be the primary vehicles for collaboration in the PLS sector as the deal terms can be very attractive. At the same time, these deal structures provide a variety of benefits to buyers as well as sellers. Buyers are able to gain access to a market or product category while mitigating some of the risk associated with the initial investment, while at the same time, managing cash flow. Sellers are able to bring in new capital or realize some liquidity while oftentimes remaining involved in the business and retaining a portion of the upside of the transaction. For example, a biotech company that has advanced a product to a late stage and secured approval in a territory where it does not have resources or the capability to distribute the product, may look for a partner to help distribute the product in that market. By agreeing to a licensing transaction, a pharmaceutical company will take over the distribution of the drug in exchange for upfront payment or royalties upon commercialization. In some cases, the biotech company will remain involved in the development of the product and work collaboratively with the licensing partner. But many times, especially in the biotech industry where capital can be scarce, companies will look to prioritize projects by licensing off some products completely and using the capital to fund others. What companies attempting alternative deal structures need to keep in mind is that it's complicated—unforeseen consequences can drain the value right out of a deal, especially if management doesn't stay focused on its long-term objectives and the value it is trying to create. For example, it can be hard to monitor whether or not a partner is fully complying with the terms of a complex agreement—something that can result in financial losses—and that is especially important when dealing with global and emerging markets. It's critical to have a centralized and consistent approach to the oversight of all aspects of these agreements. Deal success will most likely be realized by PLS companies who carefully evaluate potential deal structures and make sure that the incentives of buyers and sellers are carefully aligned.

While partnerships, licensing agreements and alliances have traditionally been conducted among PLS players, it's likely that we'll see more alliances between PLS companies and other players in the larger healthcare ecosystem in the next decade. This is one outcome of the emerging New Health Economy—driven by increasing financial power of healthcare consumers, the empowerment that advanced technology is offering to all healthcare participants, and the role that new entrants from outside traditional healthcare—retailers, consumer electronics companies, software giants—are playing in bringing fresh innovation to healthcare. The new range of partnerships will require different financial terms and a new framework for how to measure and extract value. And it will be important to keep in mind the lessons that PLS learned several decades ago when pharmaceutical companies were buying up pharmacy benefit management (PBM) companies, only to find those deals fall apart because the PBM model required access to a broader product stream than could be provided by an exclusive alliance with a single pharma company.

Funding opportunities in the capital markets

PLS companies, particularly in the biotechnology and biopharmaceutical sectors, are also looking to the capital markets to fund growth opportunities. PLS companies dominated the IPO market in the first half of the year with 59 offerings, more than double the number in the first half of 2013. Kite Pharma, Versatis, and Avalanche Biotechnologies were among the big biotech IPOs in the first half of 2014. However, these IPOs typically have raised smaller levels of investment due to the developmental stage of many biotechnology and biopharmaceutical companies—for example, in the second quarter, proceeds from PLS offerings only totaled $2.1 billion, or nearly 16% of total IPO proceeds for the quarter.

Regardless of the size, properly preparing to be a public company is critical to a company's future. An IPO is a transformational event requiring many different parts of the business to work together towards a common goal. It goes without saying that this process requires intense, long-term planning and execution in order to successfully transition into a public entity. What is sometimes overlooked in the heady euphoria of IPO preparation is that as areas of the company collaborate to get ready for a listing, management can easily be distracted from operational execution. Failing to stay focused on strong business fundamentals can undermine chances for a successful IPO.

Meanwhile, it's important to note that while the IPO market momentum in the PLS sector is expected to continue through the rest of 2014, it's likely to be a bit more subdued as a result of the IPO window not being nearly as open as it was last year. Companies that need a liquidity strategy may also want to consider alternative financing avenues, including M&A, licensing and other partnership avenues, to backstop against the time when the IPO window does close. If we don't see the same eye-popping IPO returns as companies were seeing a year ago, companies that still need liquidity will have to go the M&A route to achieve that objective.

Seeking growth abroad

Companies in the PLS industry also continue to explore opportunities to expand into new geographic regions, buoyed by increased confidence in overseas markets, especially in Europe. In the first half of 2014, several announced cross-border transactions involved decisions to domicile outside of the US. PLS companies are likely to continue to look internationally for new market opportunities while remaining mindful of issues that can derail cross-border transactions such as currency volatility, tax effects, and different regulatory environments.

The most basic reason for this is that our world and the world economy have changed and PLS companies must adapt to a new reality. In the past, it was possible for a PLS company to be successful based on business success in a single market. That is no longer the case.

This trend of globalization in the PLS industry is expected to continue both on an inbound and outbound basis. US companies looking to expand abroad will need infrastructure outside of the US and are finding it more cost effective to buy that infrastructure rather than building it from scratch. And overseas companies recognize the need to have a presence in the US to succeed on a global basis, which will likely drive additional inbound activity in the future.

Several emerging markets are presenting significant opportunities for PLS companies, including China, India, and Brazil. Establishing or expanding a presence in the Chinese market remains a priority for many PLS companies. In the first half of 2014, nine deals involved targets in China, with a total value of more than $900 million. China's economy remains the fastest growing of the world's large economies; favorable trends in demographics and public policy are creating tremendous opportunities in the region for PLS companies. At the same time, the rules to succeed in China's new economy are changing: companies that are able to adapt may be well-positioned to realize the benefits of participating in this important market.

India's healthcare market also has enormous potential, with an established domestic PLS industry, and PLS companies are ramping up their investments in the country accordingly. However, the market in India is facing significant regulatory changes that are having a direct impact on how clinical trials are conducted and how products are priced in the marketplace. Looking to the future, demographic and economic trends suggest that the country is among those most poised for growth in the industry throughout the next decade and beyond.

Brazil also offers high growth potential for companies that successfully penetrate this complex market. Projected to be the world's fifth-largest economy within the next decade, the country boasts political and economic stability and strong legislation to protect investors. At the same time, complex tax and labor regulations, compliance risks with corruption and anti-bribery laws, and post-integration issues mean that dealmaking in this resource-rich country presents significant challenges. But overall, the significant changes that Brazil's multifaceted healthcare sector has undergone allow for a more promising area for investment.

A robust future for deals

As we look over the PLS landscape, we believe transactions in all their varieties will continue to fuel value creation in the sector. Fundamentally, PLS is oriented toward dealmaking—and the increasingly intense competition for attractive assets will continue to be a key factor driving the robust M&A market. The household names who have been big acquirers in the past decade will likely continue to look for targets, but there is also a whole group of new up and comers, especially in the biotech and specialty pharma space, who have caught the M&A bug. And have used it to fuel their own rise to prominence on the global stage.

For companies looking to grow, both traditional M&A as well as alternative deal structures, can serve to accomplish several operational imperatives. Companies can supplement their R&D pipeline, diversify into new markets and products, and share risk. Economic conditions and industry trends and objectives together are driving opportunities for PLS companies to chart new courses for growth and find opportunities for successful transactions. All this can be achieved if companies considering deals maintain focus on how they expect to monetize those assets and stay disciplined in their approach to negotiations.

With product lifecycles shrinking and a new normal of pressure to consistently replenish pipelines, companies are finding M&A to be very instrumental in their growth strategies. And smaller companies are embarking on a significant M&A path earlier in their lifecycle than in the past. All these factors are pointing to a strong outlook for M&A activity as the PLS industry reshapes itself across the coming decade.

Michael Swanick is Partner and Global Pharmaceutical & Life Sciences Leader, PwC. He can be reached at michael.f.swanick@us.pwc.com. Dimitri Drone, PwC Partner and Deals Pharmaceutical & Life Sciences Leader, and James Woods, a Director in PwC's Deals practice, contributed to this article.

NOTE: All M&A data and figures are sourced from Thomson Reuters.

Regeneron, Roche Launch Major US Expansion Plans to Meet Growing Demand for Biologics and Innovation

April 22nd 2025With combined investments exceeding $53 billion, both companies are deepening their US presence through expanded biologics production, gene therapy capabilities, and next generation R&D centers.

Cell and Gene Therapy Check-in 2024

January 18th 2024Fran Gregory, VP of Emerging Therapies, Cardinal Health discusses her career, how both CAR-T therapies and personalization have been gaining momentum and what kind of progress we expect to see from them, some of the biggest hurdles facing their section of the industry, the importance of patient advocacy and so much more.