The Cost of Innovation

Drugs are cheaper in some countries and more expensive in others. And that, experts say, is a good thing, not just for companies but for patients.

Drug Companies Need Money To develop innovative products. Patients need innovative products whether they can pay for them or not. And a drug pricing policy that forgets either of these vital points is likely to be a disaster.

That was the subject of "Large Molecules, Large Dreams: A Forum on Global Drug Pricing and Sustainable Medical Innovation," held this summer at the Massachusetts Institute of Technology's Sloan School of Management. The forum brought together economists, pharma professionals, and representatives of other industries to discuss pricing issues—particularly differential pricing, the practice of charging different patients different amounts for the same drugs. At a time when differential pricing is under increasing fire from politicians and the media, the panelists saw it instead as a vital tool that allows companies to continue to develop new products, while fulfilling the industry's obligation to make lifesaving medicines available even to the poorest nations. They took a revealing look at why differential pricing is needed and how it can be preserved in the face of popular opposition, parallel trade, and price controls.

Following are some highlights from the meeting; remarks have been edited for clarity and brevity. A complete online archive of the conference, including additional presentations by Andrew Parece of Analysis Group, Inc., Stephen M. Sammut of Burrill & Company, and Yuri Dikhanov of the World Bank, among others, is available at entrepreneurship.mit.edu/forum/webcast.htm .

The $800 Million Megadifference

Ernest R. Berndt

Louis B. Seeley Professor of Applied Economics, MIT Sloan School of Management

The cost structure of the medical products industry is truly exceptional. From studies, including one by Tufts, we know that it takes between $800 million and $1.6 billion to bring the first new tablet, the first new vial, the first injection, to market. The incremental cost of producing the second unit is frequently tiny, say 25 cents. The difference between the cost of producing the first and the second tablets at the minimum is essentially $800 million.

Ernest R. Berndt

While other industries, such as electricity generation, telecom, software, database services, and motion pictures, all have high fixed or sunk costs and relatively small incremental costs, for most medical products and biologics this difference is uniquely large. Let's call it the $800 million mega difference.

There are those who dream of developing new medicines that can benefit even people with limited ability to pay. For an industry with a megadifference cost structure, this dream is realistic. It is commercially feasible to supply products at very low prices to those who are less wealthy, provided that the up-front science costs can be recouped by selling at higher prices to those who can afford them.

Of course, everyone—especially those running for office—would like a system that requires paying uniform prices only slightly greater than the so-called second-tablet cost. But the magnitude of yesteryear's and today's science investments by the biotech, device, and pharmaceutical industries reflects industry's expectations that it will continue to be able to implement global price differentials.

Because of the megadifference cost structure, medical products industries are highly vulnerable to political and economic pressures to move to more uniform global pricing. But if industry is forced to do that, investments in up-front science will drop sharply. Even more sadly, the move to uniform pricing would result in higher prices in many countries, reducing access to those unable to afford medicines priced above incremental costs. Uniform pricing ironically would make access nonuniform.

If we want to sustain the flow of innovation from medical research and development, we either have to change the $800 million megadifference price structure or figure out some way, collectively across political parties and countries, to construct and maintain a system of global price differentials.

Rewarding Results

Mark B. McClellan

Administrator, Centers for Medicare & Medicaid Services (CMS)

As healthcare costs keep rising, every country is struggling with a fundamental, growing problem: How can we possibly afford these products? Most countries see only one solution. They use their national health system to apply tough pressures on new drug prices, to limit spending to what they think they should pay—or in many cases what they want to pay. Some of the world's richest nations are driving the hardest bargains. As a result, many wealthy countries have been moving away from covering any significant part of the cost of research and development.

Mark B. McClellan

I want to be very clear that a better global solution to this problem doesn't mean that medical spending needs to go up. Many countries could do more to encourage innovation in healthcare, not by spending more but by changing the way they're spending to get more value for their citizens.

First of all, most countries need more competition when it comes to generic drugs. Generics should be made available quickly, and used widely and at the lowest possible prices as soon as legitimate drug patents expire. That happens rapidly today in the United States thanks to new reforms in our laws and regulations. With generic competition and the savings that result, more resources can be devoted to supporting new medicines. This approach encourages innovation—because you can't keep making money on the same old drug. Many countries do the reverse by holding down payments for new drugs while artificially elevating prices for older ones. The effect is to encourage keeping those older drugs around, not innovating.

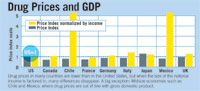

Drug Prices and GDP

Although the treatments we pay for in Medicare generally have proven benefits, we spend a lot of money on treatments whose benefits are uncertain. And we pay for many medical practices that may not be the most efficient way to deliver care. If we had better information to guide the decisions of physicians and patients, I think it would also help improve the rewards for creating truly valuable innovations. It could create an impetus for more rapid adoption of beneficial technologies, and it would also provide a clear rationale for rewarding the best technologies financially.

To achieve these kinds of benefits, the information I'm talking about needs to be developed and shared more effectively. This is someplace where governments can help. In the Medicare program, we're implementing new methods to identify priorities for Medicare-supported clinical research on treatments in which we face important questions about effectiveness or costs. This will include new steps to identify alternative study designs and procedures for gathering reliable evidence about the risks and benefits of new and potentially very valuable medical technologies.

One of the most important ways to put good evidence at the center of medical decision making is to emphasize outcomes. The new Medicare law starts to link payments not to how badly patients are doing—with more services and more complications meaning more reimbursement. Instead, we're starting to reward care that gets better results. An example of what's coming is the Chronic Care Improvement Program, created to give seniors with certain chronic conditions better education and support. Providers caring for patients with these conditions will get paid additional amounts only if overall costs go down and clinical outcomes and patient satisfaction improve as well.

We're gearing up to start as many as 300,000 beneficiaries through this program beginning at the end of this year. And we're conducting a random evaluation to determine which approaches to chronic care improvement work best for which particular kinds of patients. We're going to take those results and turn the pilot programs into nationally available additional steps based on pay for performance that will be available to all Medicare beneficiaries with these common chronic illnesses.

With more promising treatments in the pipeline than ever, I don't believe that the billions of people around the world who are suffering from diseases that should be treatable in the near future should have to wait. It's time for all of us—policy makers, developers of new treatments, and health professionals—to act on our shared interests in bringing better treatments to patients, and to work together to find ways to reduce costs and share them fairly, not just try to take advantage of the benefits of new drugs and assume that they're going to keep coming. We can set an example in a world that's getting smaller every day and that should be getting healthier every day as well.

Pricing for Access

Judy C. Lewent

Executive Vice-President, CFO, President, Human Health Asia, Merck

Differential pricing is an important subject but one that is widely misunderstood. Part of the reason may be the nomenclature. I prefer to call it "pricing for access." Drug companies sell their products for different prices in different countries so people can buy them, use them, and benefit from them. When we price for access, it's a reflection of our belief in the power of free markets to advance social good: our conviction that in meeting the world's health needs, we can also make a profit and thus continue to help prevent, treat, and cure disease.

Judy C. Lewent

There's a misconception that people in Europe and Canada enjoy the same standard of living we do. In the UK, the per capita GDP [gross domestic product] is 72 percent of that in the United States. In Germany and Canada, it's about two-thirds of ours, while Italy's is just 57 percent of ours. When I hear that Americans pay more for prescription drugs than Canadians, I think we need to put that in context. When you adjust for differences in income, US prices proportionally are actually slightly lower than those in Canada, Italy, Germany, and the UK.

We need to help people understand the merits of pricing for access. If we don't, the risk is real that the United States will repeat the mistake Europe has made. If we go down that path, Kendall Square, Research Triangle Park, and America's other research hubs will find themselves eclipsed by their counterparts in whatever nation is smart enough to duplicate the conditions right now in our country. The last thing any of us want is to be asked by some future president to serve on a task force on how to rebuild our pharmaceutical and biotech research base. We would know how to do it, but what a tragedy it would be if we had to.

A Price They're Willing to Pay

Tomas Philipson

Senior Economic Advisor to the Administrator, Centers for Medicare & Medicaid Services

Economists have known for a long time the problems of patents. Patents reward innovative activity with something we don't really like—monopoly power—and as a result, we get restricted access to products.

If a monopoly is engaged in uniform pricing, it must ex-clude certain consumers in order to make as much money as it can. They don't want to price at marginal costs, because then they can't recoup fixed costs. They want to price somewhere above marginal costs, essentially at the point at which if they lowered prices, the revenue they gained by adding new consumers would be less than the revenue lost by losing old consumers.

Tomas Philipson

Economists think that's very inefficient, because consumers who cannot afford the product would be willing to pay for it, and all parties would be better off. The consumers would get the product at a price they were willing to pay, and the companies would make more money. Hence the inefficiency—and it is all due to the fact that they can't price discriminate.

The ill of a monopoly is tied to the inability to price discriminate. And that's the center of this discussion. The issues are how to deal with the fact that we are rewarding innovation with something we don't really like—monopoly power—and how to limit the bad effects of that in the best possible way. Specifically, how do we move away from uniform pricing, which is inefficient, and go to other mechanisms?

The Price of Free Drugs

David Meeker

President, LSD Therapeutics, Genzyme

Genzyme works in the area of ultra orphan diseases — conditions that affect fewer than 10,000 individuals. The product around which the company was more or less founded is an enzyme replacement therapy for Gaucher's disease. We currently treat fewer than 2,000 individuals in the United States. The price of therapy is $150,000-$200,000 per patient, per year, an extraordinary cost.

It's a rare disease. Patients, physicians, and payers know little about it. You need to help create awareness; create education; make sure there are centers of excellence where patients can go to get evaluated and diagnosed, and to get appropriate therapy, whether enzyme replacement or something else.

David Meeker

The problem is that there is such a small population available to recoup costs. If there were 100,000 patients with Gaucher's disease, the cost of that therapy would be proportionately less. But if you go to ministries of health around the world and start to discuss pricing, they say, "Tell me what the price is in six other countries," and invariably those are the lowest-priced countries. And the negotiation goes, "Okay, we want the lowest price," or "We want the average of the lowest-priced countries."

The position we've taken is that the fairest approach is to establish one price and maintain that price to the best of our ability. We recognize our commitment to areas of the world where patients aren't able to pay, but our response to that is not that we're simply going to give free drugs to those countries. Rather, we're going to help individual patients to the maximum extent we can, but we're going to work on developing a healthcare system that can eventually assume full responsibility for those patients.

What I'm looking for when I'm having discussions with these countries is commitment. And the commitment may not be to purchase any drug. It may be that the country is going to invest in a center of excellence or in educational programs, or help the patients get organized. Over time, I expect that most countries we work with—even those in the developing world—will begin to assume some responsibility. So they're paying for the children, we will pay for the adults. They pay for one patient, we're paying for nine patients.

Now is that a 90 percent discount? No, it's shared responsibility, and I think that's an important distinction. You're not in there each year negotiating how much of a discount there will be this year. The discussions are about where we are in our partnership and our shared responsibility. And there's a tremendous pride in these healthcare systems that comes from being able to take responsibility for those patients.

IP Excess

Una S. Ryan

President and CEO, Avant Immunotherapeutics

Our model is different from Genzyme's—where you have an orphan drug, a high price, and a relatively small number of people who need the drug and can't afford it. Avant, the company I run, makes vaccines. These are needed on a global basis, so the number of people who need them is very large compared with an orphan drug.

Una S. Ryan

Large companies can provide product out of manufacturing excess for people who can't afford it. A small company like mine can't do that, but we do have what I've coined "IP excess." We're paying for patents anyway for our high-margin opportunities, and this allows us to develop products for the global community to combat the same diseases. But being able to develop them doesn't mean that we can get them to the people who need them.

The time is past for the United States to pay for all the research and development for the rest of the world and continue to let people freeload. I think all the developed nations should pay their fair share for pharmaceutical R&D, and all developed countries, not just the United States, should help pay for the developing countries' drugs.

As for how to do that, I want to start with the concept of indexing drug prices to gross domestic product. Some people may calculate it a little differently, but my method is fair and impartial. But we cannot have a system like the one I'm talking about if we don't have free market prices in the United States, which will certainly lead the way in R&D for the foreseeable future and which is currently leading the way in providing drugs to the poorer nations.

Preserving Price Differentials

Patricia M. Danzon

Celia Z. Moh Professor of Health Care Systems and Insurance and Risk Management, The Wharton School of Management, University of Pennsylvania

Although in the past companies were able to do differential pricing, the ability to do this has broken down in recent years due primarily to two phenomena: the growth of parallel trade, and extensive referencing by governments that regulate their prices based on prices in other countries. Because of these factors, the differentials are narrowing.

Patricia M. Danzon

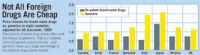

In a study that I completed recently, we looked at the prices of a fairly large market basket of drugs. The differentials relative to per capita income were about appropriate within the industrialized or more affluent countries, but for the two middle-income countries in our study—Mexico and Chile—prices were way out of line. That's just one illustration of how the existing price differentials are not optimal.

If we agree that differential pricing should exist, there are two possible approaches. One that has been proposed by Médecins Sans Frontières, the European Commission (EC), and other groups is a system of mandated discounts calculated as a percentage of some benchmark price. One EC proposal, for example, suggested that developing nations receive 75 percent off the average OECD price for drugs that treat HIV, AIDS, malaria, and TB.

In reality, the problem of disease in developing countries includes a lot of other, chronic diseases for which drugs should be available. And this approach hasn't addressed that issue. Another proposal by the EC called for a 15 percent markup over marginal costs, but that raises several questions. Which marginal cost? What if additional production capacity is required, and so on.

Even if politicians could agree on appropriate, acceptable prices, there's no guarantee that the companies would be willing to accept them. In part, that is due to the fact that the threat of parallel trade and the threat of external referencing would remain, because the price differentials would be visible. Furthermore, having a set of regulated prices like this would establish benchmarks and discourage competition below the benchmark prices.

Adrian Towse, a member of the Office of Health Economics in London, and I have proposed a system of achieving differential prices by permitting and encouraging confidential rebates. Manufacturers would sell their products to wholesalers at a fairly uniform price worldwide, but they would negotiate rebates with the final purchasers. Rebates would be contingent on purchases being made—very much the model used in the United States, where HMOs and pharmacy benefit managers negotiate discounts with manufacturers, and those discounts are made electronically. Manufacturers sell at a uniform price, but price differentials exist because of these rebates.

Because the price differences are not observable to other people, manufacturers have the ability to segment markets and confidently give different lower prices to lower-income countries, knowing those prices will not spill over to the higher-income countries. Parallel trade and external referencing are not possible. The system can be fully flexible across drugs and across countries, and it encourages and indeed builds on competition.

This proposal was designed primarily for developing countries, but it applies equally well to the differences within the industrialized world, where the need to preserve differential pricing is important, given the differences in income. The perception that Canada and European countries are on the same income level as the United States is incorrect, and it is important to preserve a way for prices to vary to subtle degrees between countries based on their differences in income.

A Pull Model for the Developing World

Hannah E. Kettler

Program Officer, Global Health Strategies, the Bill & Melinda Gates Foundation

I'm here representing the Bill and Melinda Gates Foundation, which is concerned about a lot of what's been discussed today—the goal of creating an environment in which the motivation to innovate is sustained and the outcome of that innovation is affordable, accessible products. The foundation focuses on diseases and health conditions that affect predominantly the poorest of the globe, patients living in the developing world, where not only is the disease burden significant but the potential for patient populations to afford even the cheapest medications is limited.

Hannah E. Kettler

Technically, the diseases that the Gates Foundation focus on are all orphan diseases. The key difference is that not even a small number of patients—not 10,000 nor even 2,000—are in the position to pay high prices. So one of the current focuses of the foundation is to create an environment with incentives that will facilitate innovation by the private sector. There's been a lot of discussion of the dual approach of push, trying to reduce the costs of research and development, and pull, trying to increase the expectation of a return on investment should the private sector be successful.

Now All Foreign Drugs Are Cheap

To date, the foundation has invested a lot of funds in public-private partnerships and other methods of reducing R&D costs. But we increasingly recognize that without an expectation of return on investment, we are never going to be able to afford the R&D costs—$800 million many times over—of delivering vaccines and drugs for these neglected diseases. Therefore, we are exploring how to expand the expected market for our global diseases.

In 1999, an alliance called the Global Alliance for Vaccines and Immunizations (GAVI) was established with the goal of increasing coverage for existing and future vaccines. Funding is distributed between support for building the immunization system in the world's poorest countries to increase coverage rates, while at the same time creating a vaccine fund through which countries can make proposals for funding to help cover the cost of purchasing new vaccines.

Now here's the trick. This isn't funding forever. It only covers the period when the company needs to recover the cost of R&D, scale up manufacturing capacities, and expand delivery systems. For a period of time—at the moment, five years—the vaccine fund pays the difference between the marginal cost of a vaccine and the cost that the companies are looking to receive as an incentive to complete R&D and expand their manufacturing capacity to meet the demand that ultimately will be created by this vaccine fund. The expectations are that over time the price of these vaccines will come down, the supply will expand, and the likelihood of getting some kind of return on investment will motivate new entrants.

At the moment, the primary focus has been on purchasing hepatitis B and Hib vaccines, which until recently were almost completely unavailable in the developing world. This is serving as a model to test the extent to which the suppliers and countries respond to new resources for expanding immunization. The next big challenge will be to use these kinds of pull and promise-to-pay financial incentives as a way to encourage the companies to make much more expensive investments in new product development for the diseases of poverty.

Global Disparities

Jonathan D. Quick

President and CEO, Management Sciences for Health

If we think back to 1986, the going price for triple therapy for AIDS was $10,000 in Africa or Europe. In 1997, the United Nations started negotiating and dropped the price down to $7,500. Two years later, Brazil had gotten treatments scaled up with legal competition (legal at that time under their own patent laws) and reduced the price to $4,500. Another year later, in 2000, the R&D companies got together with an accelerated access initiative, and through corporate initiative and responsibility they got the annual price down to $1,800 per person. A year later, Indian generics got it down to $1,000, and we're now somewhere under $500, perhaps under $200 depending on the market. So it's a story of a 95 percent drop over a period of six years through a combination of negotiation, competition, and corporate initiative.

Jonathan D. Quick

Three conclusions: We live in a world of huge disparities, and differential pricing is inescapable. Differential pricing is technically, economically, and politically feasible. And there is, as yet, no single strategy for implementing it globally.

Resources

Addressing Disparities in Psoriasis Trials: Takeda's Strategies for Inclusivity in Clinical Research

April 14th 2025LaShell Robinson, Head of Global Feasibility and Trial Equity at Takeda, speaks about the company's strategies to engage patients in underrepresented populations in its phase III psoriasis trials.

Beyond the Prescription: Pharma's Role in Digital Health Conversations

April 1st 2025Join us for an insightful conversation with Jennifer Harakal, Head of Regulatory Affairs at Canopy Life Sciences, as we unpack the evolving intersection of social media and healthcare decisions. Discover how pharmaceutical companies can navigate regulatory challenges while meaningfully engaging with consumers in digital spaces. Jennifer shares expert strategies for responsible marketing, working with influencers, and creating educational content that bridges the gap between patients and healthcare providers. A must-listen for pharma marketers looking to build trust and compliance in today's social media landscape.